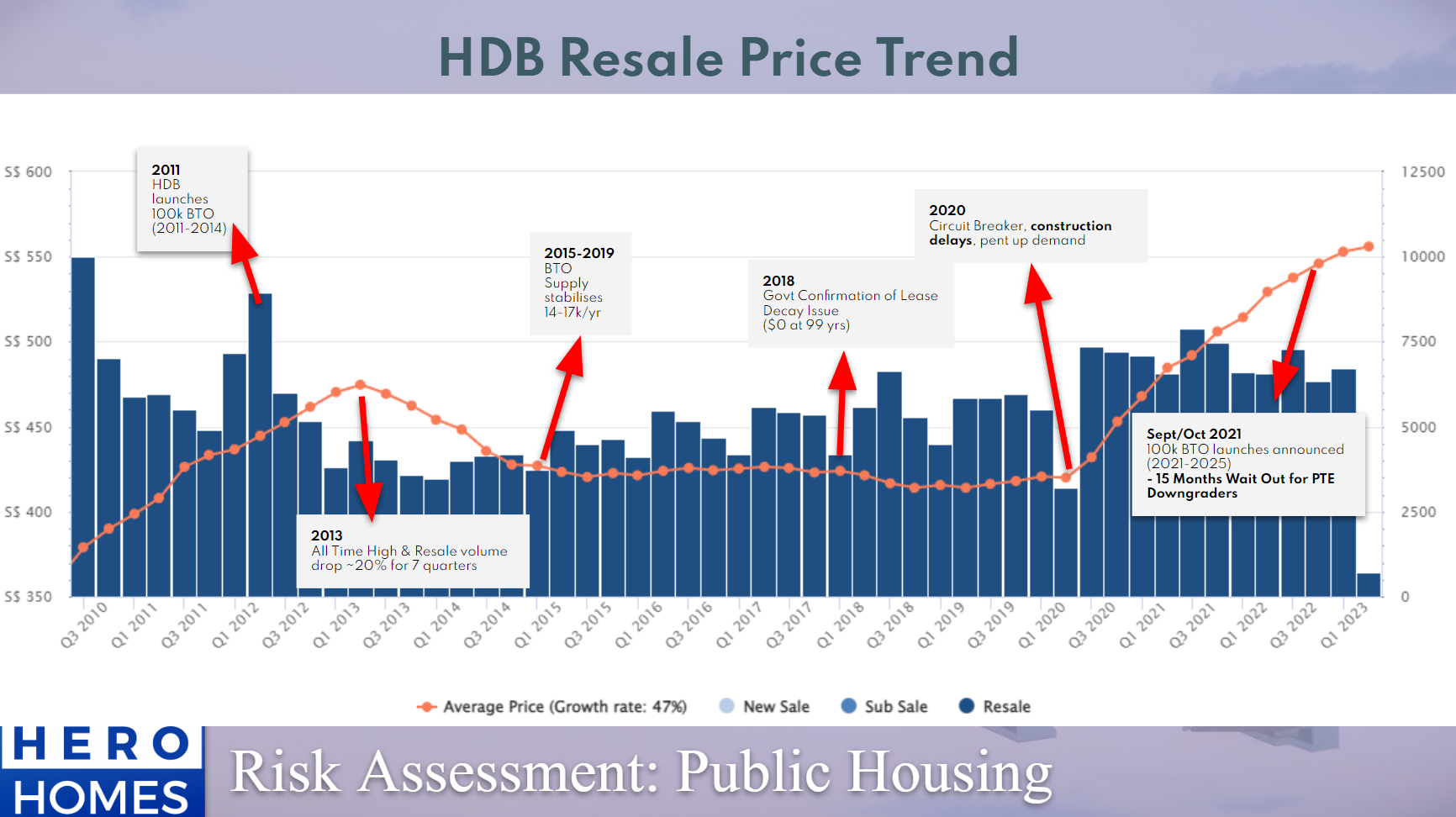

For savvy property owners and industry professionals, understanding the ever-evolving dynamics of the Housing & Development Board (HDB) resale market in Singapore is crucial. To grasp this fully, we’ll delve into a comprehensive analysis of the price trends over the past decade and more, and unveil a recent, yet underreported shift in price trends, as observed by our Herohomes team.

We begin our journey in 2011, when HDB announced the release of 100,000 Build-To-Order (BTO) flats between 2011 to 2014. As one senior official noted at the time, “The introduction of 100,000 new BTO flats was designed to meet demand and stabilize the market”. However, the release led to an immediate slowdown in resale volume and a subsequent significant price drop in 2013, as potential buyers gravitated towards these new offerings.

HDB resale prices fell by 20% within the next seven quarters. An official press release of the time attributed this sharp decline to several market cooling measures implemented by the government to keep property prices in check. But, we believe rapid decline could be attributed, at least in part, to the continued influx of BTO flats that had been announced in 2011.

As the new flats were gradually introduced to the market, they absorbed a significant portion of the demand for housing, which in turn had a cooling effect on resale prices.

During the period from 2015 to 2019, HDB prudently revised its BTO supply from 25,000 per year to a range of 14,000 to 17,000 per year. This decision, as stated by Minister for National Development Lawrence Wong, “We will continue to calibrate our flat supply carefully, taking into account underlying demand and the stability of the HDB resale market”

Fast forward to 2018, the Singapore government confirmed that HDB leases would end, leading to the return of flats for future redevelopment. This announcement by then Minister for National Development, Lawrence Wong, who is the current Deputy Prime Minister in 2023, resulted in a brief dip in HDB resale prices, as the market absorbed the implications of this policy. Wong emphasized that “the ending of HDB leases is part of the government’s long-term planning for sustainable development.”

The global pandemic in 2020 disrupted BTO construction, causing significant delays and consequently increasing demand for resale properties. Wong, commenting on the pandemic’s impact, admitted that “COVID-19 has indeed caused unforeseen disruptions, but the government is working to mitigate its effects.”

Despite this disruption, the government announced another 100,000 BTO flats in 2021 to meet the rising demand. Yet prices continued to rise, a trend that perplexed many observers and indicated a resilience in the resale market. The following year, in 2022, a 15-month time bar was introduced for private property owners looking to downgrade to an HDB flat, a measure that aimed to “ensure a fair and stable HDB market for all,” according to an official statement.

As we delve deeper into the resale price trends, our primary and secondary graphs offer visual narratives of these historical events and their implications. Particularly intriguing is our observation of a recent shift in the price trend that has gone largely unreported.

As we delve deeper into the resale price trends, this price graph offers a compelling visual narratives of these historical events and their implications. Particularly intriguing is our observation of a recent shift in the price trend that has gone largely unreported.

From Q1 2022, the resale price index’s growth began to slow down, even though the prices were still showing an upward trend, growing at approximately 1% per quarter. While on the surface this continued growth might seem to paint a rosy picture, a closer analysis suggests we might already be at the peak of the market.

Home-sellers should be mindful of this shift. Believing that prices will continue growing in the near future could be a misstep, given that there is already a significant group of new home-buyers expressing dissatisfaction with the current unsustainable growth in the resale public housing market.

Public housing in Singapore is intended to remain affordable, but since 2020, the rate of price growth has outpaced the median salary growth in the country.

This price-salary discrepancy raises important questions about affordability and sustainability. However, we will delve deeper into that topic in our upcoming blog post. For now, it’s crucial to understand that while the resale market may seem robust, underlying currents suggest that change is on the horizon.

If you’re a homeowner considering your options or a professional keen to understand these dynamics better, it’s time to engage with our Herohomes team.

To navigate these complexities, we invite you to reach out to us for a personalized presentation, where we’ll help you comprehend the current market situation. Together, we can strategize to ensure that you can benefit from the present market highs and secure a comfortable retirement through wise property investments. Engage with us today – because your future begins now.