Investing in property isn’t merely about selecting the right location or finding the perfect unit; it’s also about identifying opportunities to maximize value through strategic maneuvers like en bloc sales. In this blog post, we explore five standout developments with significant en bloc potential, offering savvy investors a glimpse into lucrative opportunities.

Introduction: Understanding En Bloc Sales

En bloc sales refer to the collective sale of all units in a residential development, typically to developers or corporations intending to redevelop the property. This process can lead to substantial returns for property owners but comes with its own set of risks and considerations. Identifying properties with strong en bloc potential requires a keen eye for market trends, property specifics, and the underlying factors that make such deals viable.

Over the past two years, our team has pinpointed five developments that exhibit robust potential for en bloc transactions. In this article, we’ll focus on one particularly promising property in District 15: Hawai Towers. We’ll explore why this development stands out, the key factors influencing its en bloc potential, and the strategic considerations for investors.

Spotlight on Hawai Towers: A Prime Candidate for En Bloc

Location: Meyer Road, District 15

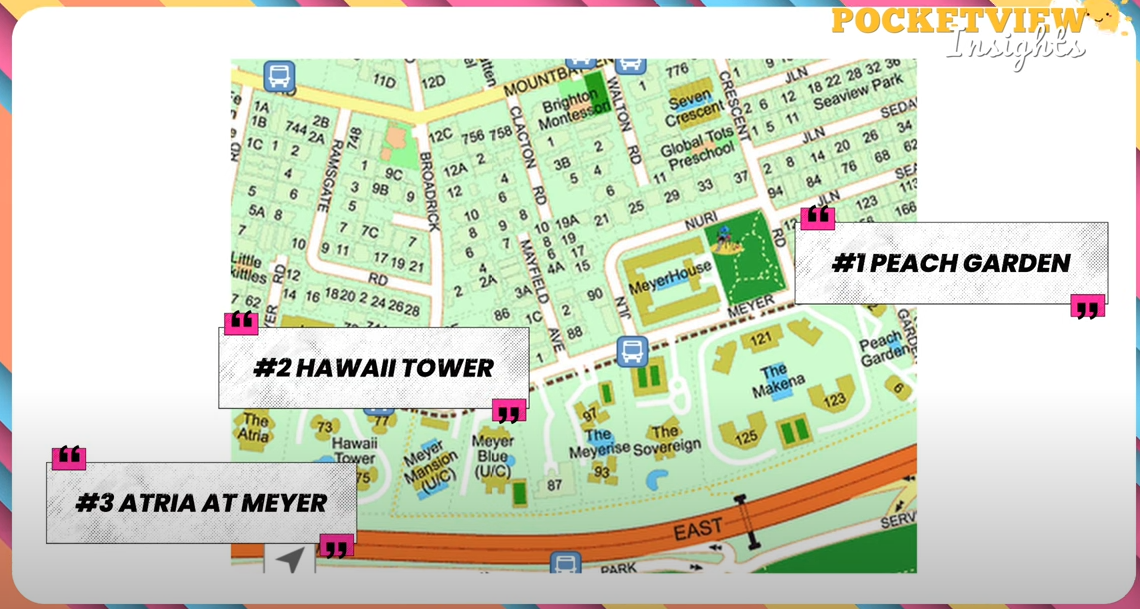

Situated on Meyer Road, one of the most prestigious addresses in District 15, Hawai Towers is among three older plots poised for potential en bloc sales:

- Peach Garden

- Hawai Towers

- Atria at Meyer Road

Why Hawai Towers?

Among these, Hawai Towers emerges as the frontrunner for an upcoming en bloc sale. Here’s why:

- Underutilized Space: Spanning approximately 192,000 square feet with only 135 units and a plot ratio of 2.0, Hawai Towers is significantly underutilized. The current Gross Floor Area (GFA) is around 310,000 square feet, while the maximum allowable GFA could reach up to 537,000 square feet based on current estimates. This gap presents ample room for developers to maximize the property’s potential. There is a potential 500-580 units that can be built by a new developer.

- Low Transaction Volume: Unlike Atria at Meyer Road, which has high transaction volumes that might deter en bloc efforts, Hawai Towers has experienced minimal transactions recently—only one in 2023 and two in 2022. This low activity suggests that new owners may be more amenable to en bloc proposals.

- Persistent En-Bloc Efforts: Hawai Towers has been on the radar for En-Bloc for quite some time, demonstrating a sustained interest among current owners to explore the property’s full potential. Although previous attempts haven’t yet secured the necessary approvals, the ongoing consideration indicates that the conditions might soon align to make an en bloc sale viable.

Comparing the Top Developments: Why Hawai Towers Leads the Pack

When evaluating potential candidates for en bloc sales, it’s essential to consider the unique attributes and circumstances of each development. Here’s a comparative analysis of the three prominent developments on Meyer Road:

1. Peach Garden

Peach Garden boasts a substantial amount of long-term investment, with residents having inhabited the property for decades, if not generations. This deep-rooted residency creates a stable community that sees little incentive to relocate, thereby reducing the likelihood of an en bloc sale. Furthermore, there hasn’t been any recent movement or initiatives aimed at unlocking this property, indicating a content and settled ownership base resistant to change.

2. Atria at Meyer Road

In contrast, Atria at Meyer Road has seen attempts to initiate an en bloc sale. However, these efforts fell short of securing the necessary 80% approval from unit owners. Additionally, the development has experienced strong transaction volumes in recent years, which suggests that new owners might primarily be investors less inclined to support an en bloc initiative. This high turnover rate can lead to opposition, making it challenging to achieve the required consensus for En-Bloc.

3. Hawai Towers

Hawai Towers distinguishes itself from the other developments through several key factors:

- Substantial Plot Size: Covering approximately 192,000 square feet, Hawai Towers offers ample space for redevelopment. This expansive plot size, combined with a manageable 135 units and a plot ratio of 2.0, indicates significant underutilization of available space.

- Growth Potential: The current GFA stands at around 310,000 square feet, but based on our estimates, the maximum allowable GFA could reach up to 537,000 square feet. This substantial difference highlights vast potential for developers to maximize the property’s value through enhancing its existing structure.

- Low Transaction Volume: Unlike Atria at Meyer Road, Hawai Towers has experienced minimal transaction activity, with only one sale in 2023 and two in 2022. This low turnover suggests a more stable ownership base, which could be more receptive to en bloc proposals compared to developments with high investor turnover.

- Persistent En-Bloc Efforts: Hawai Towers has been considered for En-Bloc for quite some time, signaling ongoing intent among stakeholders to realize the property’s full potential. Although previous attempts haven’t yet secured the necessary approvals, the ongoing interest indicates that the right conditions could soon align for a successful en bloc sale.

Key Factors Determining En Bloc Potential

When assessing a property’s en bloc potential, several critical factors come into play. Understanding these can help investors make informed decisions and mitigate risks.

1. Transaction Volume

Contrary to intuition, higher transaction volumes can sometimes be a red flag for en bloc sales. In developments like Atria at Meyer Road, robust transaction activity suggests that newer owners may have different expectations or opposition to en bloc proposals. In contrast, Hawai Towers’ low transaction volume indicates a stable and potentially cooperative ownership base, enhancing its en bloc appeal.

2. En-Bloc History

A property’s history of attempts to En-Bloc provides insight into its en bloc viability. Consistent efforts to secure approval, even if initially unsuccessful, demonstrate ongoing interest and potential. Hawai Towers has a track record of attempted En-Blocs, signaling ongoing intent among stakeholders to realize the property’s full potential.

3. Risk to Reward Ratio

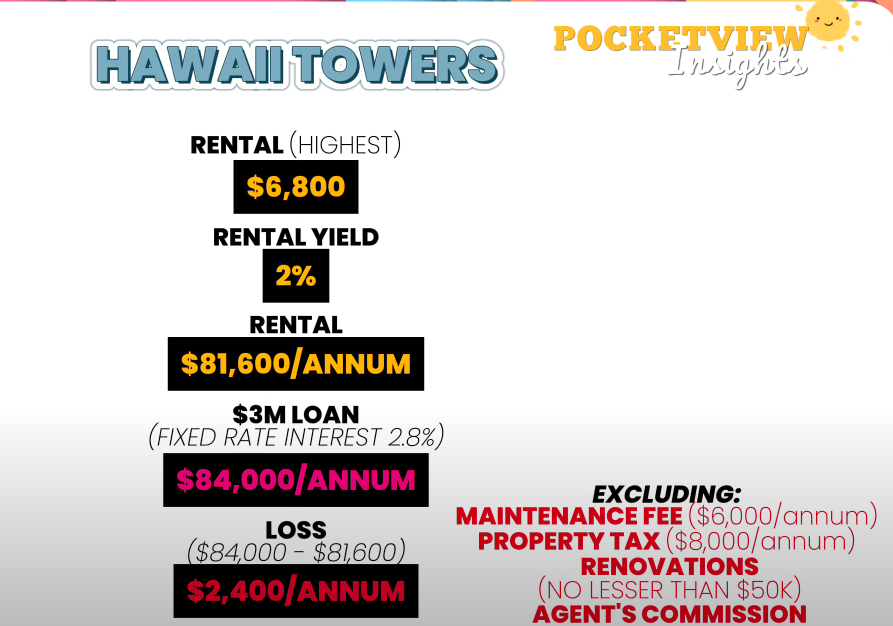

Investment decisions hinge on balancing potential rewards against inherent risks. For Hawai Towers:

- Current Valuation: Recently sold at approximately $4 million, below its previous reserve price of around $6 million.

- Potential Upside: As en bloc potential becomes more apparent, property values are likely to climb, offering significant returns.

- Risks: If en bloc approval doesn’t materialize, investors could face negative returns due to maintenance fees, property taxes, and necessary renovations to meet modern standards.

Investment Strategy: Maximizing Returns with Hawai Towers

Investing in Hawai Towers requires a strategic approach:

- Long-Term Hold: Purchase the property with the intention to renovate and hold long-term. Enhancing the property’s value can yield substantial returns, especially if an en bloc sale proceeds.

- Flexibility with Timelines: Avoid setting rigid timelines for en bloc approval. Instead, focus on the property’s intrinsic value and market appreciation over time.

- Renovation and Maintenance: Allocate funds for renovations to ensure the property meets contemporary standards. This not only enhances its appeal but also its resale value, whether through an en bloc sale or in the secondary market.

Silver Lining While Waiting for En Bloc Approval

While waiting for en bloc approval can be uncertain, there are strategic advantages to holding onto the property during this period:

- Premium Investment: By investing in Hawai Towers, you are already paying a premium due to its en bloc potential. This initial premium positions you favorably in the market.

- Market Appreciation: As the en bloc potential becomes more evident, property prices in Meyer Road are expected to continue climbing. For instance, if upcoming developments like Meyer Blue launch at around $3,000 to $3,200 per square foot—a record for District 15—over the next 3 to 4 years, Hawai Towers’ low price per square foot ($1,800) offers a significant growth opportunity.

- Price Comparison and Value Growth: Buyers purchasing units at $3,000 to $3,200 per square foot will likely aim to sell at $3,500 to $3,800 per square foot. Meanwhile, Hawai Towers, priced at $1,800 per square foot, is almost half the price of new developments like Meyer Blue. Even if Hawai Towers’ price rises to $2,200 per square foot, it’s still 60% of Meyer Blue’s pricing. This differential means substantial value appreciation at a lower investment.

- Inflation and Market Dynamics: As newer properties transact at higher prices, Hawai Towers may naturally rise in value due to inflation and market dynamics, not necessarily because it becomes more desirable in its own right. This organic price increase can provide investors with built-in capital appreciation.

However, it’s essential to consider the following:

- Unit Sizes and Market Fit: Despite its large size at 2,239 square feet, Hawai Towers comprises only two-bedroom units. While spacious, this configuration might cater to a niche market, presenting its own set of challenges in terms of buyer preferences and resaleability.

- Renovation and Maintenance: Older properties like Hawai Towers may require significant investments to upgrade, impacting overall profitability if an en bloc sale doesn’t materialize.

Risks and Considerations

While the potential rewards are enticing, it’s crucial to be aware of the associated risks:

- Negative Cash Flow: Without en bloc approval, ongoing costs such as maintenance fees and property taxes can erode returns, leading to negative cash flow.

- Renovation Costs: Older properties like Hawai Towers may require significant investment to upgrade, impacting overall profitability.

- Market Fluctuations: Real estate markets are inherently volatile. Relying solely on en bloc potential is risky, as market dynamics can shift unpredictably.

- Unit Configuration Challenges: The large two-bedroom units may not appeal to all segments of the market, potentially limiting resale options or rental demand.

Conclusion: Is Hawai Towers the Right Investment for You?

Hawai Towers on Meyer Road presents a compelling investment opportunity for those with a budget of up to $4 million seeking properties with strong en bloc potential. Its underutilized space, low transaction volume, and history of En-Bloc attempts make it a prime candidate for future development and value appreciation.

Strategic Advantages:

- Cost-Effective Entry: With a price per square foot significantly lower than new developments, Hawai Towers offers a cost-effective entry point with substantial growth potential.

- Market Appreciation: As surrounding properties like Meyer Blue set new pricing records, Hawai Towers stands to benefit from organic price increases fueled by inflation and market dynamics.

However, Prospective Investors Must Consider:

- High-Risk, High-Reward Nature: The investment carries substantial risks, including potential negative cash flow and significant renovation costs if en bloc approval doesn’t materialize.

- Unit Configuration: The large two-bedroom units may limit appeal to certain buyer segments, affecting resale and rental potential.

Investment Recommendation:

- For Long-Term Investors: If you have the financial resilience to hold the property long-term and are comfortable with the inherent risks, Hawai Towers could be a lucrative investment, especially if en bloc approval proceeds.

- For Risk-Averse Investors: If stable cash flow and minimal risk are your primary concerns, investing in properties without en bloc potential might be a safer option.

As always, conducting thorough due diligence, consulting with real estate professionals, and carefully assessing your financial situation are paramount before making significant investment decisions.

Interested in Exploring Hawai Towers or Other En Bloc Opportunities?

If you’re considering investing in properties with en bloc potential or want to learn more about Hawai Towers, feel free to reach out via WhatsApp or give me a call. Let’s explore how you can make the most of these promising real estate opportunities.

Investing in real estate offers numerous avenues for growth and profit. By staying informed and strategic, you can navigate the complexities of the market and unlock the true potential of your investments.