Are Resale Condo Prices Peaking?

What I Discovered After Studying 10 Years of Data

By Heikal Shafrudin, HeroHomes.sg

Over the past few months, I’ve had multiple clients reach out with the same question:

“Heikal… are we buying resale at the peak?”

It’s a fair question.

When prices look high, and new launches are making headlines, it’s easy to feel like you’ve “missed the boat.”

But what I’ve learned — after watching this market daily since 2010 — is this:

Price without context is just noise.

So here’s the context.

No hype. Just what the data really says.

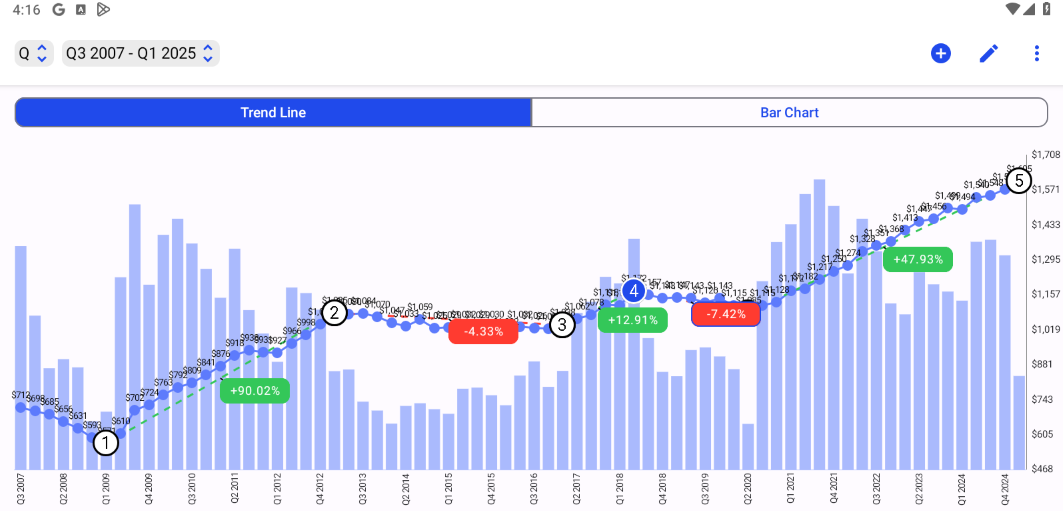

📉 Rewind: The Resale Winter (2011–2020)

Between 2011 and 2020, OCR resale condos barely moved in price.

(Image: OCR RESALE Condo Price Growth)

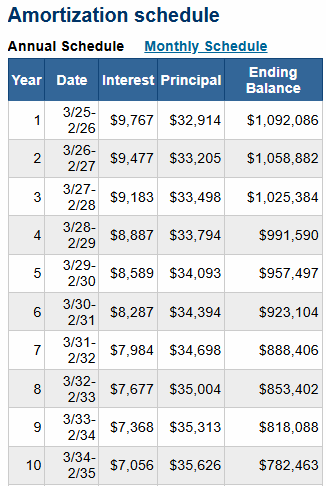

And this was despite the fact that mortgage interest was at historic lows.

Imagine this:

-

Property: $1.5M

-

Loan: $1.125M

-

Interest rate: 0.88%

-

Monthly repayment: ~$3,556

-

Annual interest: <$10,000

Practically free money.

And yet… resale prices were flat.

Why?

(Image: Ammortisation table for $1.5mil Purchase with 0.88% interest)

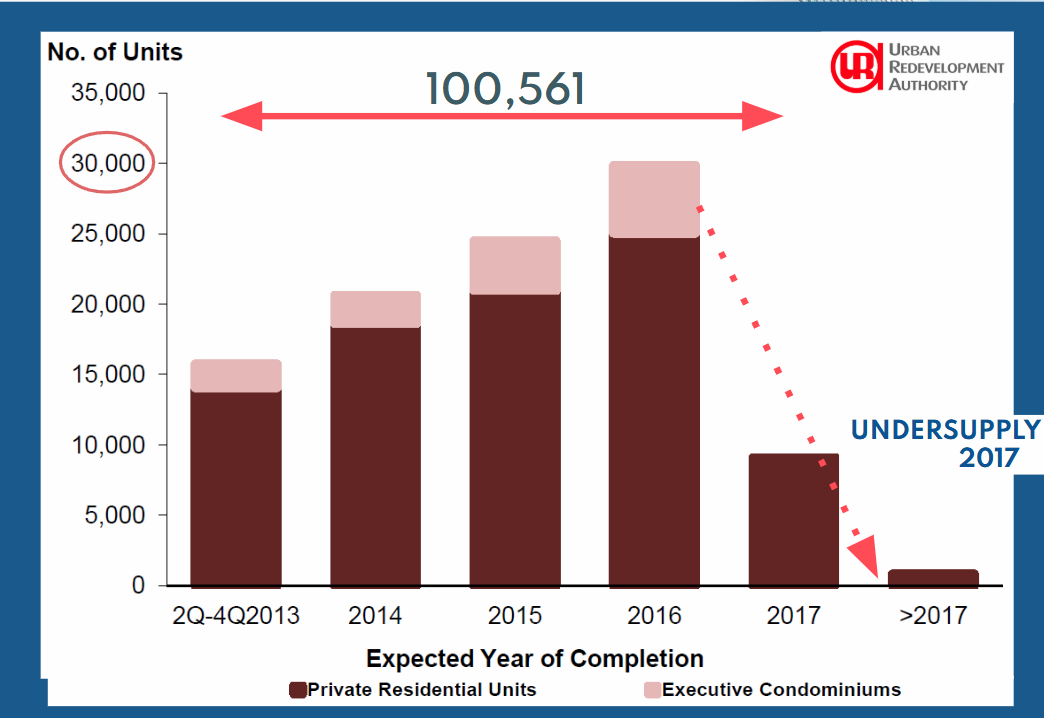

Because we were flooded.

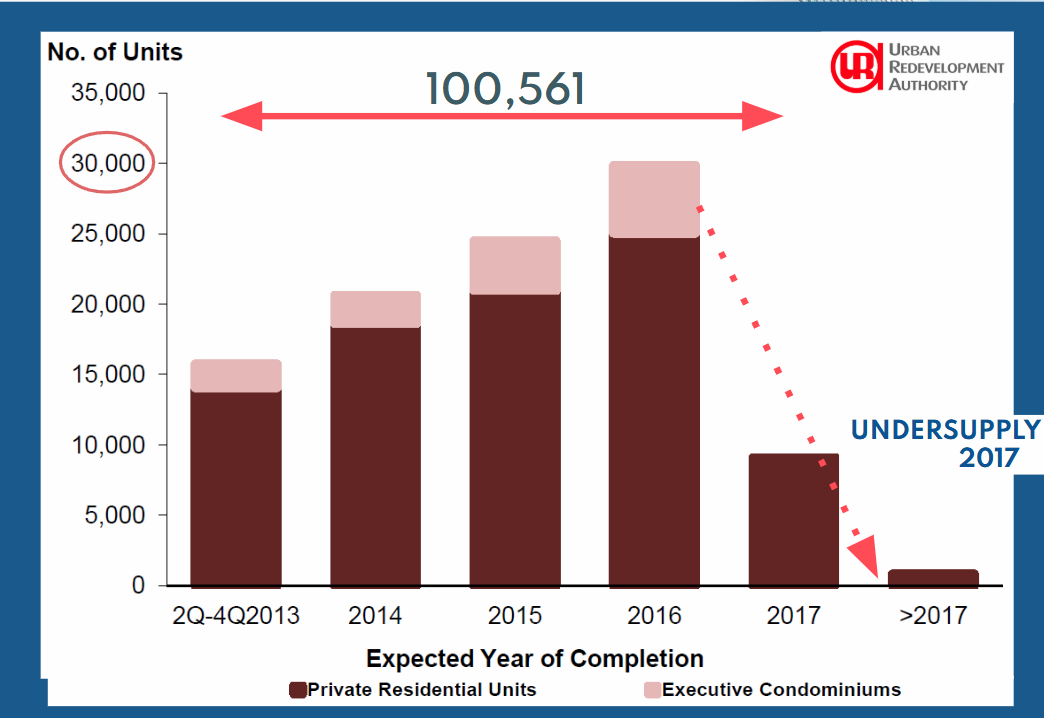

After the 2011 elections, developers were in full swing.

From 2013 to 2017, more than 100,000 new condo units entered the market.

Buyers flocked to showflats. Resale sellers lost leverage.

Even condos that were just 5–10 years old couldn’t compete with shiny new projects.

(Image: Screengrab from Herohomes Sales Deck of URA Pipeline Supply of Condos Completing Each Year 2013-2017)

🔍 Real Case Studies: The “Before and After” Effect

Let me show you two examples I dug up from actual transactions.

📊 Case Study A: Livia (Pasir Ris)

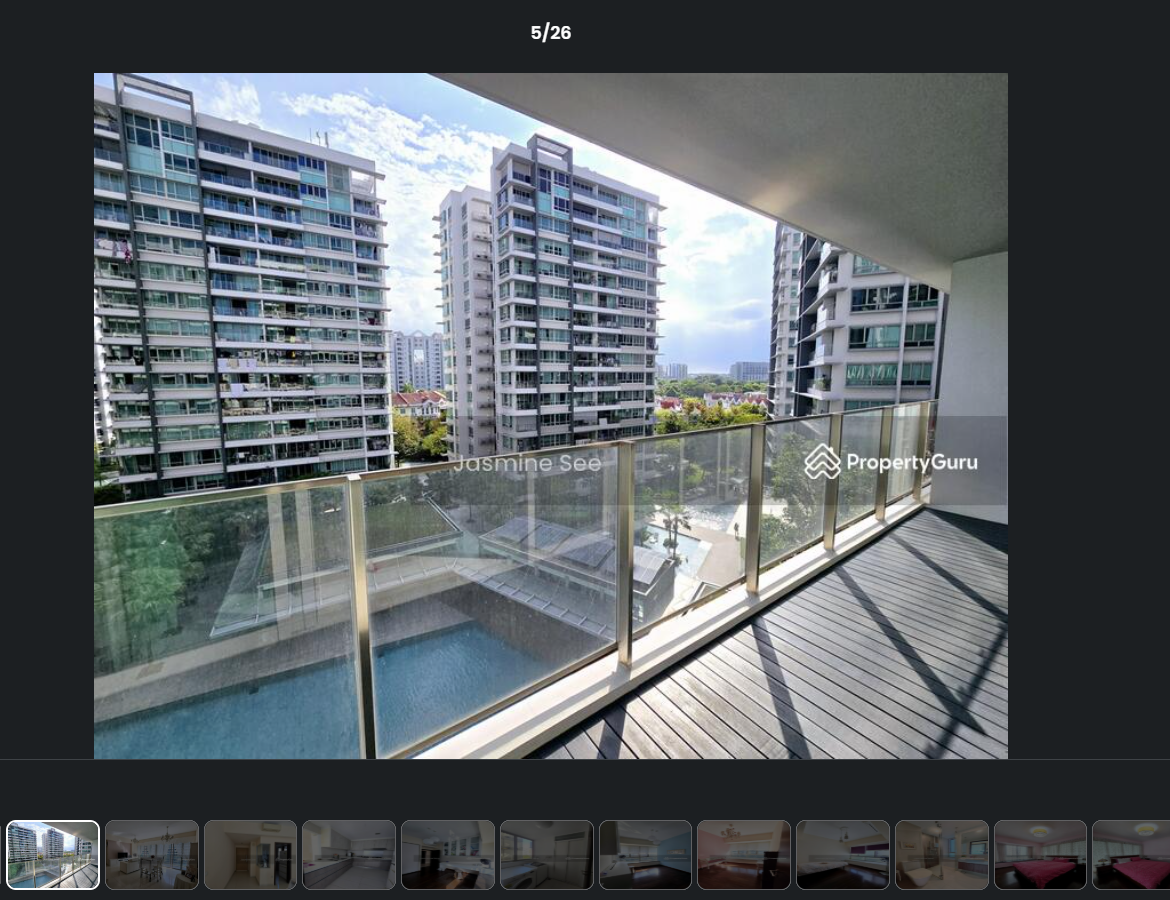

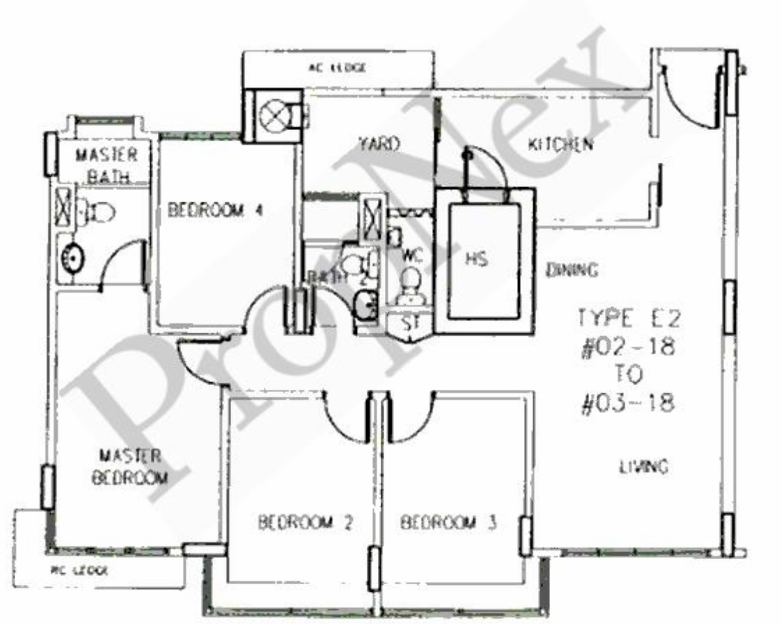

(Image: 1,539sqft Layout in Livia)

(Image: View from a 1,539sqft Layout for Sale on Propertyguru.com.sg)

1,539 sq. ft., full facilities, near MRT.

-

2011: Bought at $1.35M

-

2015: $1.4M

-

2020: Still $1.4M

-

2025 (est.): $2.1M

Nearly 10 years of sideways movement.

Then the market moved — and it moved fast.

📊 Case Study B: La Casa (Woodlands)

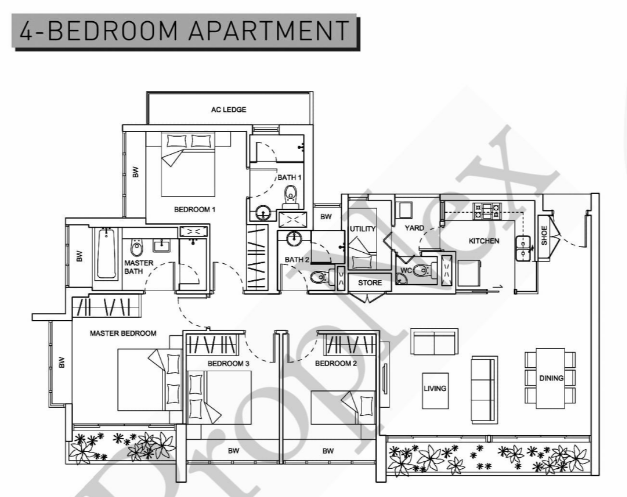

(Image: 1,259sqft Layout in La Casa)

1,259 sq. ft., 4-bedder.

-

2013: Bought at $1M

-

2015: $990K

-

2020: $998K

-

2023: $1.25M

-

2025 (est.): $1.65M

Again — 7 years of “meh”.

Then a 60% jump in under 5 years.

These patterns aren’t random.

They’re the result of one thing:

Supply tightening.

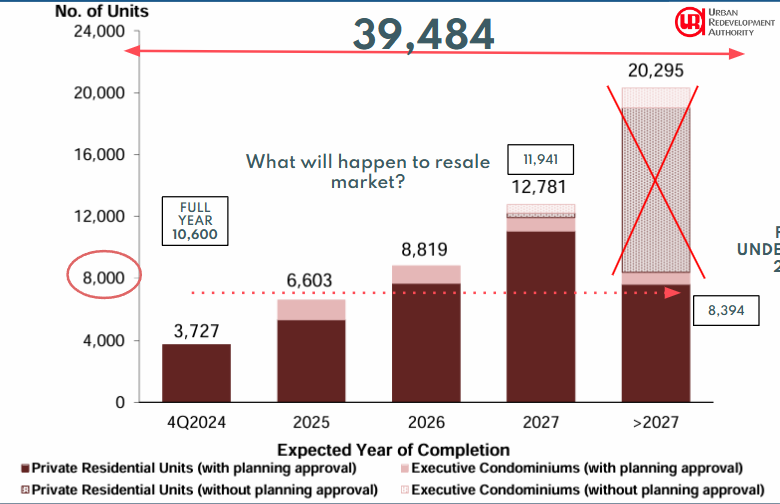

📦 The URA Pipeline: What Really Changed?

Between 2013–2017:

(Image: Screengrab from Herohomes Sales Deck of URA Pipeline Supply of Condos Completing Each Year 2013-2017)

-

Over 100,000 private units launched

-

20,000 units hitting TOP every year

-

Buyers spoilt for choice

-

Resale units had to discount just to stay relevant

Now, from 2024–2027?

(Image: Screengrab from Herohomes Sales Deck of URA Pipeline Supply of Condos Completing Each Year 2024-2027)

-

Just 39,000 units in the pipeline

-

Only 8,000 units completing per year

That’s a 60% drop in new supply.

And when supply drops, the resale market becomes relevant again.

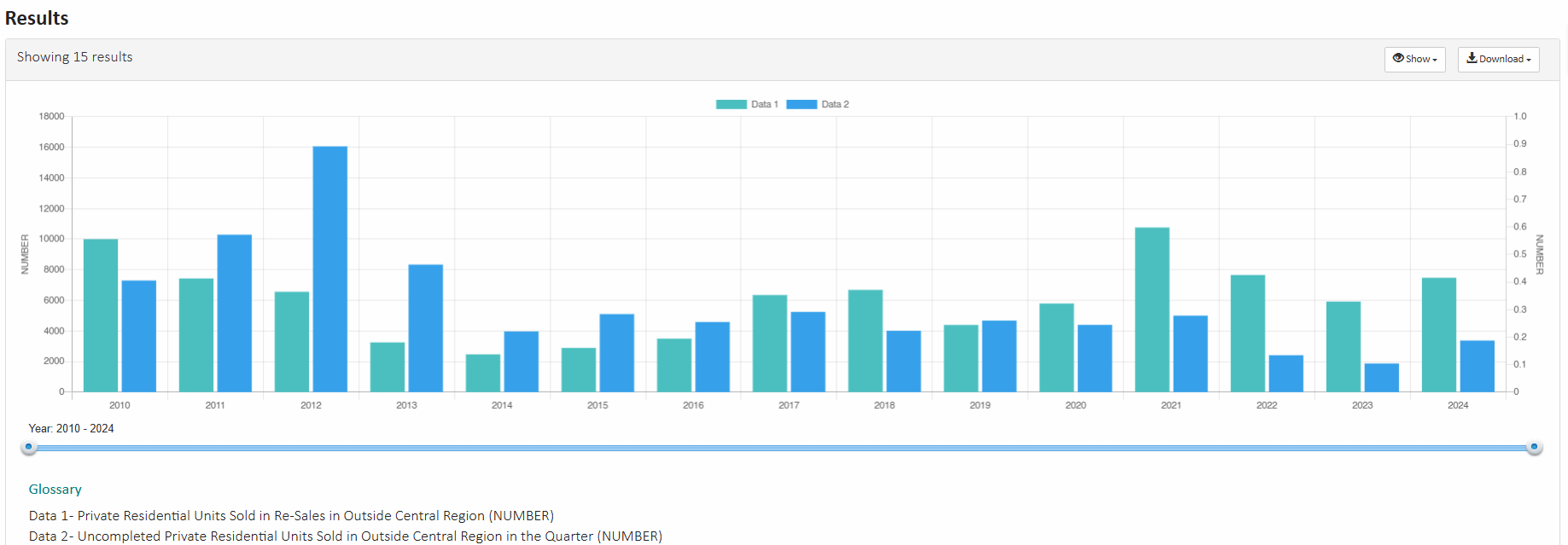

🔄 Resale Transactions Are Surging

Between 2010–2020:

(Image: Graph of Resale Transactions vs New Launch Transactions in the OCR Market from 2010)

-

Avg new launch transactions: 6,725/year

-

Avg resale transactions: 5,391/year

New launches dominated.

But post-2020? That flipped.

Buyers began turning back to resale.

And there’s a reason for that.

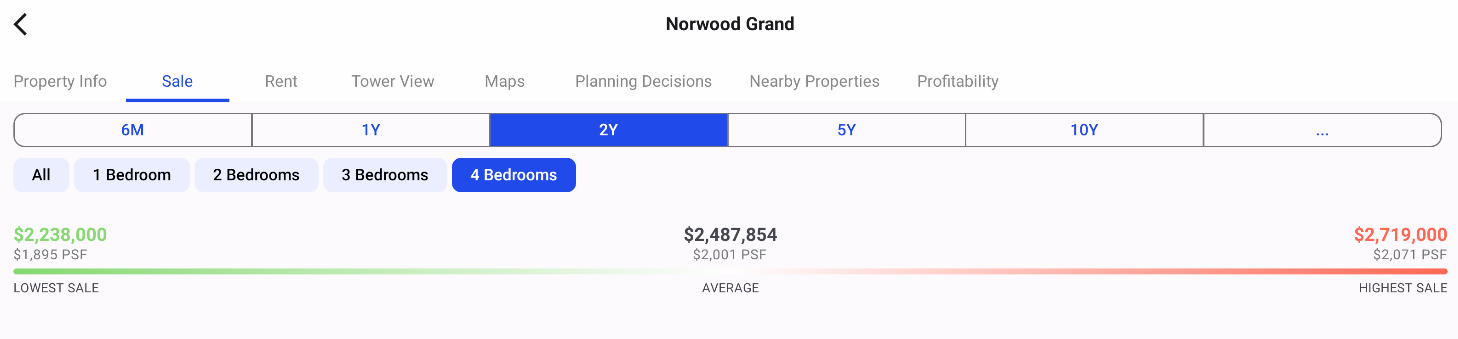

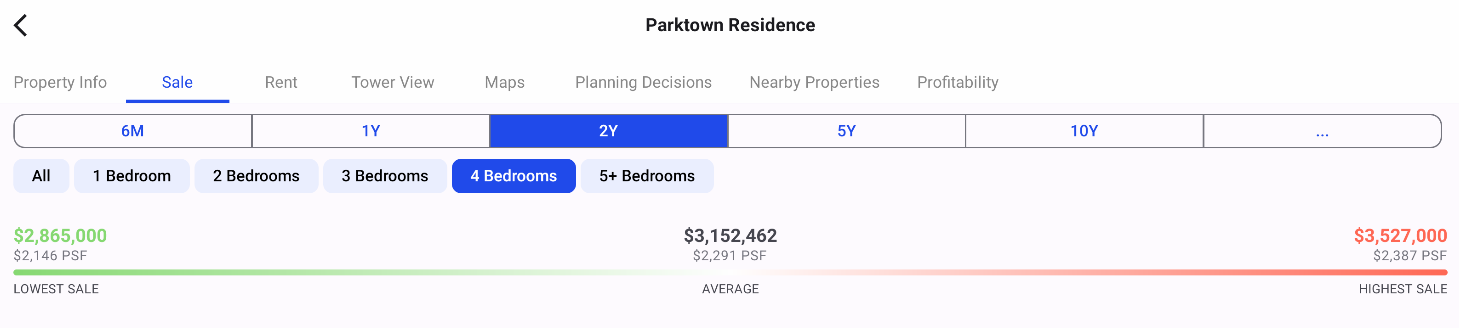

💡 It’s Not Just Price — It’s the Price Gap

The average price gap between new launch and resale used to be 10–15%.

Today? In many OCR areas, the gap is 40–60%.

Take this:

-

Norwood Grand 4-bedder (Woodlands): $2.48M

-

Parktown Residences 4-bedder (Tampines North): $3.15M

But resale 4-bedders in the same towns?

$1.5M to $1.8M.

Same floor plan. Same space.

Half the price.

That’s not a discount.

That’s value.

💰 But What About Mortgage Rates?

Yes, interest rates have climbed.

Here’s a quick comparison:

2025 Buyer:

-

Interest: 2.45%

-

Loan: $1.125M

-

Monthly: ~$4,415

-

Annual interest: ~$25K

2013 Buyer:

-

Interest: 0.88%

-

Annual interest: <$10K

So yes — it feels more expensive.

But with resale prices significantly lower, total cash outlay is still far more manageable.

Especially for HDB upgraders, or families who just need space.

🏡 So, Should You Wait for Resale Prices to Drop Again?

Let’s recap:

2011–2020:

-

Oversupply

-

Resale stagnated

2020–2025:

-

Supply drops

-

Price gap widens

-

Resale gains traction

Could prices drop again?

Only if we see a new wave of supply and lower launch prices.

And based on URA’s pipeline — that’s not happening anytime soon.

💭 Final Thoughts

Headlines love the word “peak.”

But “peak” without context creates fear.

And fear isn’t a strategy.

If you’re planning your next move — especially as an upgrader — this might be your window of advantage.

Let’s break down your options together.

📲 DM me on Instagram @herohomes.sg

🧠 Or visit www.herohomes.sg

No pressure. Just clarity, backed by facts.