Introduction

Welcome to your next big step in real estate! Transitioning from an HDB to a new launch condo offers exciting opportunities for upgrading your living space and lifestyle. This guide is tailored specifically for HDB owners looking to navigate the new launch condo market efficiently. We’ll walk you through the process, highlighting essential considerations and strategies to enhance your buying experience.

Step 1: Assess Your Readiness

Before delving into the market, it’s crucial to evaluate your current housing situation and how it aligns with your aspirations of purchasing a new condo.

Financial Readiness and Implications

Selling Your HDB: One critical aspect to consider is the Additional Buyer’s Stamp Duty (ABSD). As an existing property owner, purchasing another property means you could be liable for ABSD, which significantly increases the cost of buying. However, if you sell your HDB before or shortly after purchasing a new condo, you may be eligible for an ABSD refund under certain conditions. This makes it financially advantageous to sell your existing HDB to alleviate the additional tax burden.

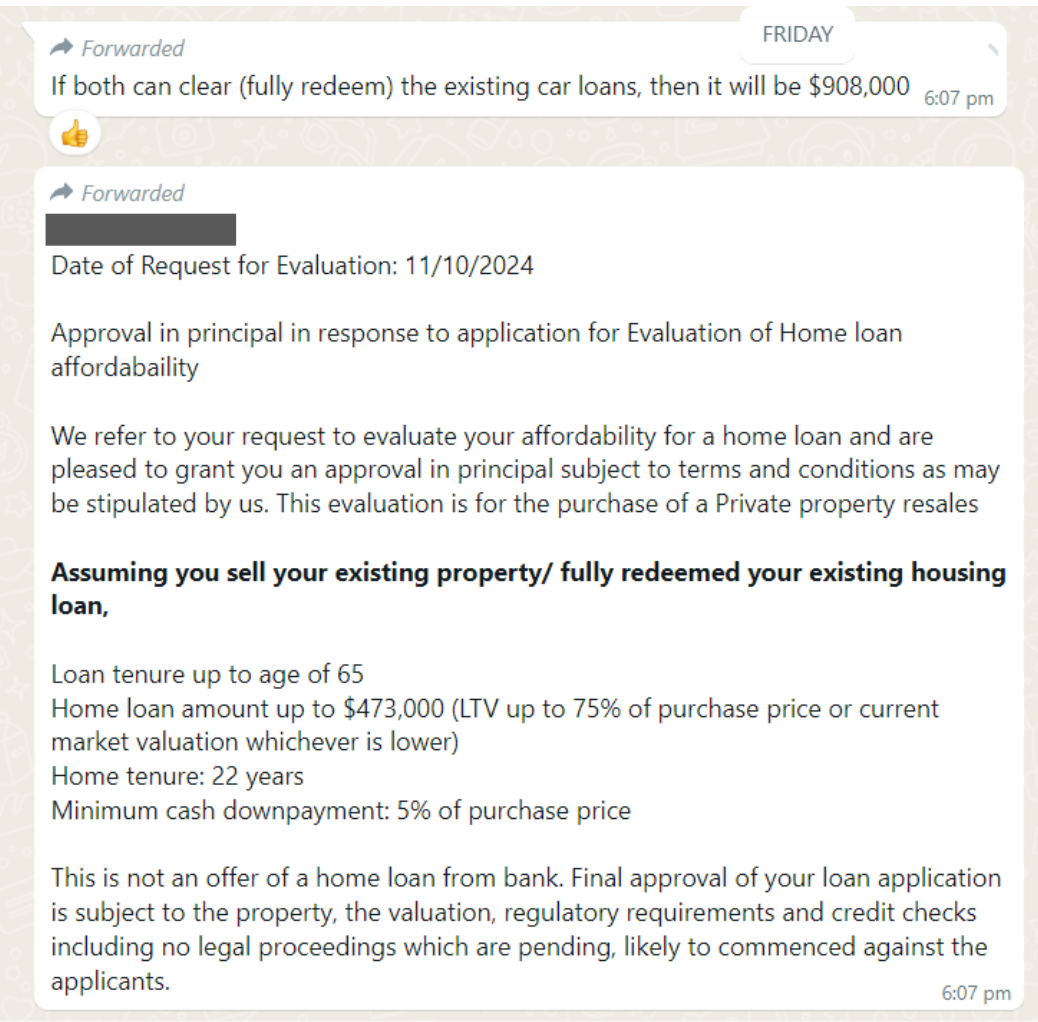

Financial Planning: Secure a mortgage pre-approval to define your budget clearly. Knowing exactly how much you can borrow and afford will streamline your search and

decision-making process.

Step 2: Preview Day

Taking initial steps at the preview day can set the tone for your purchasing journey:

- Strategic Visits: Visit on less crowded days to have meaningful conversations with agents and a better look at the property without pressure.

Step 3: Visiting the Show Flat

This step is more than just viewing potential homes; it’s about understanding the property’s potential for future value.

- Understanding Layout and Design: Discuss with agents about the project’s layout ethos. A good layout not only suits your lifestyle but can also enhance the property’s future saleability and profitability. Agents can provide insights into which designs are most favored in the market and why, helping you make a choice that balances personal preference with investment savvy.

- Selection Strategy: Keep an open mind but be prepared with questions about the benefits of different units based on their layout, view, and potential market appeal.

Step 4: VVIP Launch Day

Leveraging early access can provide a competitive edge:

- Pricing Strategy: Gain early insights into the pricing structure to plan your finances effectively. Discuss these figures with your agent to understand the market

positioning of the condo.

- Make Informed Decisions: Communicate clearly with your agent about your decision to proceed based on the comprehensive information gathered, including layout preferences and pricing.

Step 5: Launch Day

The culmination of your preparation:

- Decisive Action: With limited time to decide, your prior research and discussions will enable you to choose swiftly and wisely.

- Celebrate and Plan Ahead: After securing your condo, consider your next steps in personalizing your space and planning your move.

Legal Aspects and Market Considerations

- Legal Review: Always have a lawyer review all transaction documents to ensure your interests are protected.

- Market Awareness: Understanding current and projected market trends can help you gauge the long-term value of your investment.

FAQs

FAQ 1: What is the typical timeline for a new condo launch?

Answer: The timeline for a new condo launch usually begins with the announcement of the project, followed by a preview period (show flat viewing), then the VVIP launch, and finally the public launch. From preview to public launch, it can span several weeks to a few months, depending on the developer’s schedule and marketing strategy.

FAQ 2: How does the progressive payment scheme work for new launch condos?

Answer: For new launch condos, the payment is typically structured as a progressive payment scheme. This means you pay in installments, corresponding to the construction stages of the project:

- Booking Fee: 5% cash payment when you sign the Option to Purchase.

- Sales and Purchase Agreement (S&P): Another 15% within 8 weeks of booking.

- Construction Phases: Payments are then staggered according to construction milestones such as completion of the foundation, structure, roofing, etc., typically amounting to 65% of the purchase price.

- Completion: The remaining 15% is usually paid upon obtaining the Temporary Occupation Permit (TOP).

FAQ 3: Can I use my CPF to buy a new launch condo?

Answer: Yes, you can use your CPF Ordinary Account (OA) funds to finance the purchase of a new launch condo, subject to CPF withdrawal limits and regulations. You should check the specific amount you can use from your CPF, which depends on factors such as your age, the remaining lease of the property, and CPF regulations at the time of purchase.

FAQ 4: What should I consider when choosing a unit in a new launch?

Answer: When selecting a unit, consider factors such as:

- Orientation: Look for units that avoid direct west sun in tropical climates, which can help in keeping your home cooler.

- Floor Level: Higher floors might offer better views and less noise but can be more expensive.

- Proximity to Amenities: Units closer to facilities like the clubhouse, gym, or pool might offer greater convenience.

- Privacy: Corner units or those with fewer neighboring walls may offer more privacy.

- Future Developments: Be aware of any upcoming developments around the area that may affect your living experience or the property value.

- Why is layout important? The layout affects both your enjoyment of the property and its future marketability. Choosing a layout that appeals to broader market preferences can enhance profitability when it’s time to sell.

FAQ 5: What are some common pitfalls to avoid when buying a new launch condo?

Answer: Some pitfalls to be wary of include:

- Overleveraging: Avoid stretching your finances too thin; ensure you can handle the mortgage alongside other financial commitments.

- Ignoring Market Trends: Stay informed about real estate market trends and economic factors that could impact your investment.

- Neglecting Due Diligence: Always conduct thorough due diligence on the developer, the project, and all legal documentation. Ensure there are no hidden clauses or unexpected fees.

- Failing to Plan for Delays: Construction delays can happen; plan for them financially and have alternative living arrangements if necessary.

- Overestimating Rental Demand: If buying as an investment, realistically assess rental demand and potential yields rather than relying on optimistic projections.

FAQ 6: What is Additional Buyer Stamp Duty (ABSD) and how does it affect me?

Answer: ABSD is a tax imposed on second and subsequent property purchases. As an HDB owner, selling your unit first can help mitigate this additional cost.

Can I avoid paying ABSD? Selling your HDB before buying a condo or within a stipulated timeframe allows for a possible ABSD refund, subject to specific conditions.

Conclusion

Moving from an HDB to a new launch condo is an exciting journey that, with the right preparation and understanding, can be financially rewarding and personally fulfilling. This guide aims to equip you with the knowledge and strategies to make informed decisions, ensuring a smooth transition to your new home.

Ready to take the next step towards your dream condo? Contact a reputable property agent today and start your journey with confidence. Your new home awaits!