Just last Saturday I brought a buyer down to a HDB executive apartment at Pasir Ris it was the last house we viewed. I was tired since I had back to back viewings since Thursday and wasn’t prepared for the seller to walk up to me and reveal his story. At the end of his story I felt like Heikal and me have failed in our mission.

I bid my buyer goodbye and stayed back to hear the seller’s story, what he revealed is a lesson I feel we should have shared a long time ago to you.

A little backstory: He already had an agent for over 3 months, an ex-colleague who ventured into real estate and he wanted to support his ex-colleague but now he’s starting to have small fights with his wife over his choice. His agent does not come down for viewings and so far had only had 3 viewings over 3-months.

I simply listened and acknowledged his story but after 30 mins I felt disappointed with a fellow professional agent and no wonder the profession has such a bad reputation among consumers. I felt like the agent didn’t act in the interest of his clients, maybe unintentionally.

That’s why I’m writing this post for you on a Tuesday afternoon and I hope we all can learn something from this seller’s story. Good news is we are now taking over the listing and I can report that he received 4 viewings over 1 week and hopefully we can get an offer within the next few days.

1. He was planning to buy a 42 year old HDB flat in Chai Chee.

He said that he wanted to live closer to his aging parents who were living in Chai Chee, just behind the Al-Ansar mosque and he wanted to buy a spacious HDB flat, similar to what he is enjoying now.

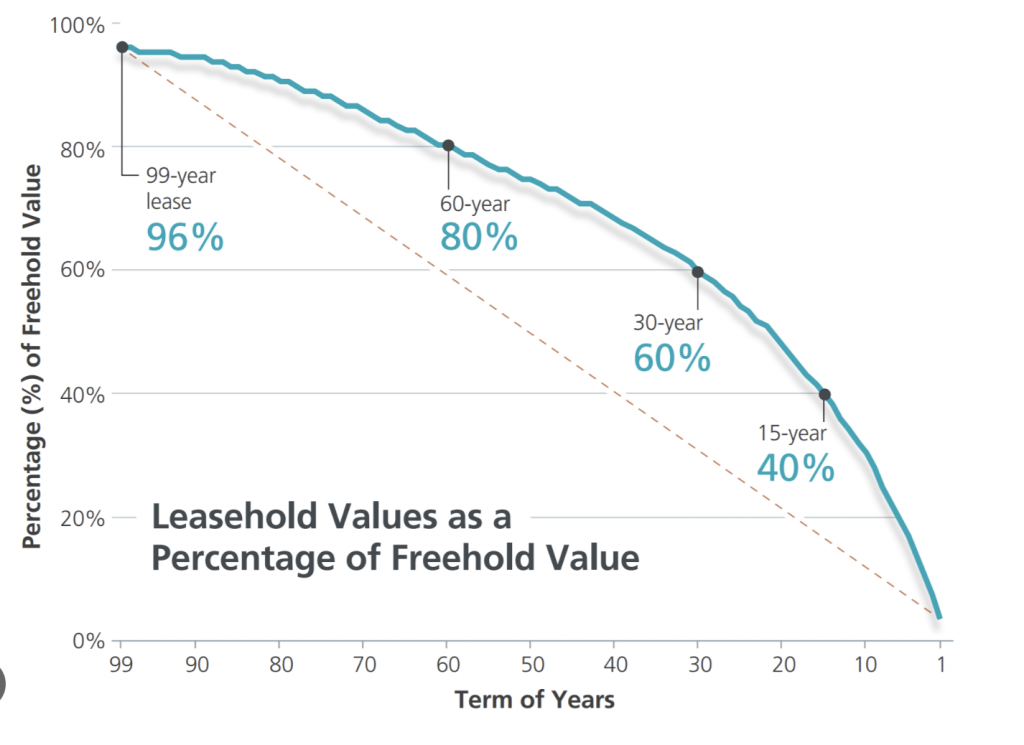

Unfortunately the range of blocks he was interested in are all over 40 years old. The first thing that came to my mind was lease decay, his hard earned CPF and profits from the current HDB flat will be burned away. Years of work and toil all gone.

Often, upgraders focus mainly on the flat’s size, renovation, or location. While these are important, it’s equally crucial to understand factors like lease decay or the ‘Bala Curve’ effect, showing how a 99-year lease property in Singapore can lose value over time. Not all old HDB flats are a bad investment, but many might not be the best choice for future downgrading or retirement.

Source for a HDB flat that has a much higher potential to appreciate or at least plan a way to retire without the help of your old HDB flat by investing in other types of investment vehicles.

I went deep into his requirements and we found a suitable HDB flat, although old (not that old) had a better potential for him to exit profitably in the next 10-15 years. The next lesson is something that is a personal no-no.

2. He didn’t know he could afford a much younger HDB flat.

Why did he want to buy that old 42 year old HDB flat in Chai Chee? While he wanted to live near his parents he simply looked for the cheapest. He assumed that he couldn’t buy something that was $40,000 more but his instalments were more or less the same with a few tweaks.

Point of this is that many aren’t aware of the range of options available, including resale HDB flats, condos, ECs, new launches, and even landed properties. Surprisingly, most private property and EC owners don’t make hefty cash payments monthly because they simply don’t go through a deeper analysis of their options. Knowing all your options can significantly impact your financial decisions and property profitability.

In fact almost 50% of the time our clients buy properties based on this financial deep dive instead of their original decisions.

3. He had only 2 goals. Live near his parents and buy a big house.

He had only 2 priorities, buy a HDB flat near his parents and something spacious like his current Pasir Ris HDB flat. When I looked into his plan I discovered that it was shortsighted since he should have planned for his retirement as well.

We structured his instalment plan for the next property to take into account his retirement plan. I made sure that when he reached 55 years old that he will meet his Full Retirement Sum even if he chose to stay on his HDB flat.

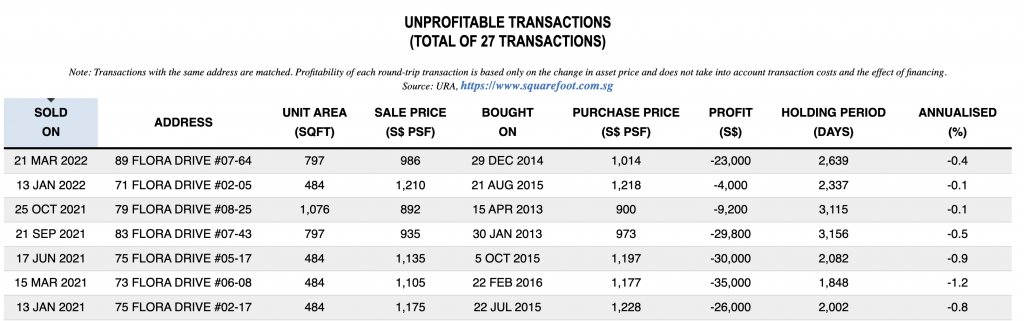

4. He said that he considered a resale condo because the agent said it was going to be profitable.

Another misconception. All condos will make money but the truth is not every private property purchase equates to a good investment. Avoid hastily buying a resale condo without thorough analysis. Sometimes, your goals and affordability might even suggest that an HDB flat is a more suitable option.

For example, one of the few things we recommend is to use our 4x Condo Upgrading Framework before you decide on the future profitability of the resale condo.

5. The agent he chose was his only choice. An ex-colleague.

He chose to work with this agent as they were in the same company many years back and he didn’t know any other agent. I think choosing a friend to be your agent is not a problem IF you have had interviewed at least 3 agents.

While this seller choose his friend the way most people choose a property agent is by going onto Instagram and looking at a profile of an agent who shows beautiful HDB flats. They then decide that this is the right agent to help with their upgrade. While the agent is a good sales agent, he/she probably doesn’t have the right skillset to advise you on your plans.

They are order takers and they help you calculate what you want to buy. Sure they might whip out a glorified calculation of your HDB sales proceeds, which you can actually do on your own.

After meeting 3-4 agents you should give yourself a break, a cooling off period, before you decide what’s best for your family. Do some research and interview agents before just following the other 99% blindly.

Simply following the crowd and choosing the most ‘popular’ agent like a talent show will not do your family justice.

6. Relying too much on online advise and ending up confused.

This is not necessarily a bad thing but he said that he did alot of research online before he decided to sell his property but the problem is that there’s too much information out there and many conflicting advise by property agents or even news outlets.

Basically he didn’t know which to believe and thought an “expert” could help him sift out the information overload.

Here’s the thing: there’s just too much information out there, and you’ll often think that it’s better not to do anything after over-analysing it all. You’ve got different needs. You’ve got different goals.

There’s so many creative ways to achieve your goals, but the internet doesn’t get it most times.

7. He thought about doing a DIY upgrade or a discount agent.

On the 3rd month of his exclusive with the agent he was disillusioned and thought that he could have done a better job or maybe even get a fixed price agent to help him sell his property.

I personally use this rule as a guiding principle in all my purchases or goods or services, what is cheap may not be necessarily good. In fact it could be expensive, very expensive. Here’s why:

If he did a DIY upgrade he could be missing out on reaching a greater audience for his property. It’s not only about having a propertyguru.com account but rather the strategic pricing, negotiation techniques that can increase your property price by an extra $15,000 to $40,000 (for example the Closed Bidding Strategy) and many much more unique skills a good agent can bring to the table.

If he got a discount agent to help him sell then it’s expensive considering a discount agent only help with 2 things:

1: Paperwork

2: Listing your property on property portals at what price you are looking at.

In fact they don’t give you deeper insights since their main focus is the 2 things I mentioned. In fact a discount agent charges $2,000 but listing on propertyguru is only $200. You can easily text agents to offer them $500 to put your property up on Propertyguru.com and you can do your own paperwork, which is actually easy to do by reading the HDB guides.

In fact not getting the advise from a discount agent is the best thing you could do since there is a high cost to the bad advise that could be $100,000 over the lifetime of your property ownership journey.

But engaging the right agent would save you stress and make you more money:

1 – Sell $20,000 higher in 7 days.

You’ll save yourself at least $5,000 in unnecessarily stressful time and effort dealing with salespeople (that you are buying the property from)

1. You buy a property that will increase in value by $300,000 in 4-15 years depending on what you are aiming for.

2. You retire with $4,000 a month using property profits.

3. You’ll know exactly what you’re paying and your property plan will help you reach your goals.

There are many more benefits to engaging with the right agent.

Conclusion

I’m sure there are many more mistakes HDB BTO upgraders make, but these are the ones that come to mind as I was writing this after the meet-up with the seller. Selling or buying a property is a life-changing decision, whether it is a HDB flat or a private home.

I hope the lessons I’ve shared have been helpful and if you are interested to know more about our HDB Upgrading Frameworks and how it could help you then reach out to us.