What is HDB, and what does it stand for?

Historically, this particular government sector has undeniably created a foundation of Singapore’s national public housing development to where it is today. Our grandparents may be one of the first generations of Singaporeans who experienced the differences before and after HDB was first established.

Presently, six decades have already passed, do you think our generation of zoomers still views HDB as a vital sector of this country’s public housing development?

To find the answers, we’ll spend the rest of the few minutes traveling back in time. We will re-learn what is HDB and relive the main purpose of its existence sixty-one years ago.

As we uncover detail after detail about this sector, it makes sense to start asking this most frequently asked question to understand your potential in Singapore’s real estate journey from a nation of slums to skyscrapers. Let’s begin.

What is HDB & Why Does It Exist?

After 144 years under the British regime and two years before the short-lived Malaysian Federation collapsed, Singapore has officially been declared an independent state since 1965.

As a young republic, the nation was unstable, chaotic, and above all, many Singaporeans lived in horrible living conditions. At the time, the majority of its people were living in conditions described as “the prevalence of unhygienic slums and crowded settlements” or what the Malaysians know as the “kampong.”

Although a kampong literally means traditional villages, the term was once coined to describe the urban slum areas in a few countries, such as Indonesia, Malaysia, Cambodia, Christmas Island, including Singapore back then.

Why does HDB exist in Singapore?

According to Sharanjit Leyl’s account about her grandfather published on BBC, Singapore attracted many Asian immigrants due to its increasing popularity as a bustling trading nation in the early 1930s.

My father and his siblings grew up on a large plot of land that sits in current-day Bukit Merah, an area in central Singapore whose name means “Red Hill”. My grandfather claimed the land by planting a perimeter of banana trees which formed dense foliage and kept others out. Then he built a house so large, he would later rent out its back rooms to lodgers. But the house, like many at the time, was rudimentary.

My aunt, Manjit Kaur, was born there in pre-independence Singapore. ‘It was a hard life. There was no water, no healthy water,” she says. “We lived a simple life, our neighbours were simple. We looked after each other and we had the same goal – to survive.”

Sharanjit Leyl

As a result, the country faced an unprecedented national housing crisis primarily due to the lack of sanitation. The living conditions were at their worst.

These painful realities for the majority of Singaporeans at that time consequently led to officially establishing the Housing & Development Board, simply known as HDB. It exists as a statutory board under the Ministry of National Development, from 1960 to this present day.

What Does HDB Do?

Officially declared as a sub-government branch more than 50 years ago, HDB exists primarily to ensure that the majority of Singaporeans can afford public housing property without compromising the quality of living.

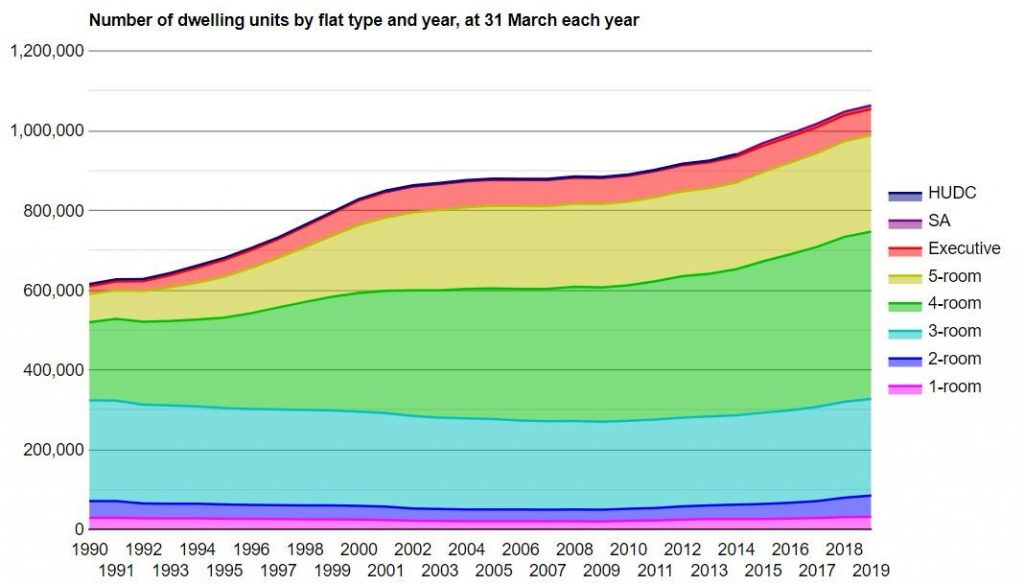

Within ten years, they housed as many as 54,000 flats and more than a million in the present. That means 80% of Singaporeans live within the four walls of affordable public housing, and 90% of them own HDB properties.

As a response to the alarming national housing crisis, the government needed a long-term strategic plan of removing the urban slums in the country as fast as their economic development grew.

To make this plan work, they need to offer a cheaper housing alternative for middle-income to low-income earning families. So, HDB has been offering a wide array of options to apply for eligibility to own properties.

This consecutively led to providing ways for average citizens to apply for housing loans to grants; or, to choose, purchase, and sell HDB flats, DBSS, to ECs. The outcomes will depend on their personal property preferences, and, of course, their overall budget.

4 HDB Flat Types Available Today

Currently, you have four HDB flat types to choose from, based on HDB’s official website, namely:

- 1-room to 5-room

- Executive flat

- Multi-generational flat

- Design, Build, and Sell Scheme (DBSS) flat

If you are already an HDB property owner, here’s what I’ve got for you.

Click here to find out what you’re actually missing out on Singapore’s real estate market and property investment.

How Much Deposit Do I Need For An HDB Flat?

To find out how much deposit do you need for an HDB flat, we need to explore the processes involved prior to financing your flat, including the requirement of coming up with a comprehensive financial plan.

According to their official website, you need to submit the following as prerequisites to evaluate your eligibility and the costs and fees you may need to pay from your loans and/or grants availed, namely:

- Cash and CPF Ordinary Account Savings

- Housing loan

- CPF Housing Grants

- Staggered Downpayment Scheme

- Deferred Downpayment Scheme

- Temporary Loan Scheme

- Fresh Start Housing Scheme

If you have no idea how to calculate your current finances, I recommend you use this HDB Tool right here. Using the tool will also help you calculate the amount you need to loan to finance your flat purchase.

Cash & CPF Ordinary Account Savings

Reviewing your Cash and CPF Ordinary Account Savings is part of the entire eligibility process to finance the HDB flat.

This option opts HBD to ask you for a “resale flat financial planning” draft that covers both the amount of cash required for the specific flat and the amount payable from your CPF Savings account.

HDB Financing Option 1: Cash Savings

When it comes to your cash savings, as the name implies, HBD will collect the deposited amount to the seller with a maximum of $5,000 in cash paid in two stages, which include the option fee and the deposit.

If you struggle to gather sufficient funds for the flat, or if you take a bank loan as an additional option, HBD will collect a part of the initial payment based on the HDB flat type.

Similarly, if you choose to take a second HDB loan to buy the resale flat, HDB will ask you to set aside the amount at your disposal in cash to right-size the loan amount of the second HDB loan.

That means your incurring expenses like furnishings, renovations, etc. will also be taken from your cash savings.

HDB Financing Option 2: CPF Savings

Another alternative to finance your HDB property is taking advantage of your CPF savings. This is to pay for either the part of the entire price of the HDB flat or for its installment payments.

In addition to paying the entire flat, you also rely on your CPF savings for the accumulated costs needed for the aesthetics of your property. Primarily, this is to increase the property value to the onlooking HDB buyers.

This decision depends on your priorities, whether you take a loan from HDB per se or from other financial institutions in the country.

| To calculate your current CPF Savings, you can use the CPF Board’s online calculator. Just click right here to start right away. FYI, for flat applications received starting 10, May 2019 with at least 20 years and 60 years lease, you have to review the latest HDB’s conditions. |

Honestly, if you’re confused as to how this all works together, feel free to shoot us an email to answer all your questions. Just fill in the form below.

2. Housing Loans

Every Singaporean citizen has the right to accessible housing, including you, which is an arduous task for any government to handle. Yet, this young republic showed an unequivocal desire to bring the country to where it is today.

Historically, the earlier generations of Singaporeans were deprived of their basic needs for a long time. Many people had no choice but to endure the pain of watching their daily lives like reels played in slow-motion, which eventually scarred the nation.

Perhaps, those events left such deep wounds that the government established HDB to accommodate the public housing needs of its citizens. They offered different options, but here’s the catch.

HDB Housing Loan Eligibility Criteria

Before you could avail of the benefit of a housing loan, you have to be eligible based on citizenship, household status, income ceiling, ownership/interest in the property, and remaining lease. Otherwise, you have to reconsider your options to finance your HDB property.

Yet another interesting condition you need to look at is how HDB tries its hardest to offer affordable housing for all Singaporeans as equally as possible. Thus, only one family member of each household can only avail of one flat even if their household income allows them to own more.

Whether in Singapore or abroad, HDB will also look into your ownership or interest in the property records at least 30 months before your HDB Loan Eligibility (HLE) application date. So, if you want to avail the benefits of any of their housing plans, owning a private residential property is a pretty bad idea.

It doesn’t matter if you received it as a gift, as an inheritance as a beneficiary of the Intestate Succession Act, or through nominees, HDB won’t give you a chance for eligibility if they find anything like this in your application.

Required Income Ceiling for Extended Family

Once you have a proven clear history of any private property ownership, HDB will take a look at your average gross monthly household income, especially if you’re an extended family. The total amount will serve as the determinant of the income groups, namely:

- Group A – Regardless of whether you are a widow/widower or you’re still engaged with your partner, as long as you are the parent to a single child/children, you belong to this group if the sum of your monthly income + your family members’ income does not exceed $14,000/month.

- Group B – If one of your children marries, you belong to this group, given that your average gross monthly household income, including the income of the married child’s family, does not exceed $14,000/month.

- Extended Family – To simplify the description, your household belongs to this group if the total sum of the incomes of Group A and B does not exceed $21,000.

To explain this better, here’s an example from HDB:

The husband and the wife both earn $4,000 from their respective jobs. Plus, the couple has three single children; all of them are already working adults earning $3,000/month each. If they want to avail themselves of an HDB flat, they have to review their gross monthly income, making sure that the sum will not exceed $21,000/month.

What if the couple submitted their HLE applications and flat applications before 11 September 2019?

If ever you did, the income ceilings will be $3,000 less compared to the subsequent years after the date. So, HDB requires $12,000 for families and $18,000 for extended families.

What if I qualify, how much will I get?

Depending on your financial status and remaining lease, the HDB Housing Loan Loan-to-Value (LTV) Limit table shows that new flat applications submitted before 16 December 2021 will get up to 90% of the purchase price and 85% for those applications submitted on or after the said date.

For instance, you applied for the housing loan and submitted the requirements before 16 December this year. Let’s say the HDB received their share from both the seller’s and buyer’s resale applications.

If everything went well during the processing period, you might get up to 90% of the flat value. But what if it isn’t the case? What if it’s the other way around?

| HDB flat applications submitted before 16 December 2021 | HDB flat applications submitted on or after 16 December 2021 |

| 90% of the purchase price | 85% of the purchase price |

Here’s how it would be in case you missed the date. Since you missed the scheduled date and subsequently delayed your submission, as per the HDB Housing LTV Limit table, you will get 85% of the flat value instead of 90%.

Do you think there’s much difference between the two conditions and their respective outcomes? Is filing for an HDB housing loan worth the hassle or not? What are your thoughts about it? Let me know in the comment section below.

3. CPF Housing Grants

When your cash savings, CPF savings, and housing loan applications didn’t turn out well, HDB offers a variety of CPF Housing Grants as financial support to Singaporeans who want to own HDB resale flats.

These grants will not only depend on you and your partner’s history of receiving housing subsidies but the type of property you want to own as well. For instance, there are separate CPF Housing Grants for HDB flats, DBSS flats, and ECs.

On the other hand, HDB also categorises them into seven different groups based on their history in receiving housing subsidiaries, such as:

- First-Timer Applicants

- First-Timer and Second-Timer Couple Applicants

- Second-Timer Applicants

- Non-Citizen Spouse Scheme

- Living With/Near Parents or Child

- Joint Singles Scheme or Orphans Scheme

- Singapore Citizen Applicants

Depending on the result of your application, HDB will assign yours based on the seven CPF Housing Grants listed above. Whichever grant you will receive upon evaluation, the financial support you get support from will cover the costs and fees of an HDB resale flat in addition to the resale flat price itself.

What are the HDB Resale flat costs and fees do the CPF Housing grants cover?

- Resale application fee – an administrative fee that both buyers and sellers need to pay

- Processing fee for Request for Value – the fee for asking HDB to determine your flat’s value

- Fire Insurance – an additional fee if you take an HDB housing loan to purchase a fire insurance policy from HDB’s appointed insurer (FWD Singapore Pte Ltd)

- An administrative fee for Temporary Extension of Stay by flat sellers – If you agree to the seller’s request to stay longer, you will have to pay an administrative fee to HDB.

- Legal fees – The total amount you have to pay for legal fees depends on your appointed solicitor to purchase the flat on your behalf. For instance, you appoint HDB as your solicitor. So, you have to pay the legal services offered to you based on the HDB (Conveyancing Fees) Rules 2002.

Pros & Cons of HDB Flats

Let’s find out the pros and cons of owning an HDB flat or any HDB property by looking at the list below. It’s a list that I came up with after extensive research combined with years’ worth of personal experience in real estate investment and property management in Singapore.

Pros

- Since its establishment in 1960, HDB has been providing a variety of housing loans and grants tailored for average Singaporeans, especially those working blue-collar jobs.

- HDB has not only made sure that you have different options to finance your property. They also encouraged you to choose a variety of property types, depending on your personal preferences and your funding capacity.

- Historically speaking, HDB housed the majority of Singaporeans which is approximately 80% of the country’s entire population. As a result, it has contributed to its rapid economic development, specifically removing the urban slums in the metropolitan area.

Cons

- Owning HDB flats apparently is generational. Given the majority of Singaporeans live in these kinds of properties, it might convince you to inherit the living conditions. Hence, it draws you back from wanting to buy new properties you think your family deserves.

- Unlike private properties, HDB flats tend to depreciate over time, in general. In case you want to sell your old HDB flat someday, you have to expect lower returns.

Final Thoughts: What is HDB & What Does It Mean To You?

You may be owning an HDB flat right now. Maybe not or still planning to own one someday. Whatever your situation is, if you’re like most Singaporeans, unfortunately, you believe that you can never afford private property.

Given the money you all have, you think it’s impossible to upgrade your HDB flat and move to your dream home. But here’s the truth. Many Singaporeans just like you managed to sell their HDB flats and buy condos. You say what?

It’s true. And the truth is, we’ve had a lot of clients who are ready to tell their stories to you. If you like to read their inspiring moments, you can check out our success stories here.

Intrigued? Feel free to talk to us. At Herohomes, we are always here to listen to you. Fill in the contact form below, so we’ll keep in touch. Give us at least 24 hours before we could get back to you.

I’ll truly appreciate your time reading this post, so it’d be great if you could share your thoughts about this topic in the comment section below. Have a nice day!