Ready to dispel the myth that buying a resale property is a surefire way to lose money in the Singapore property market? We’ve got the secret: RESALE Executive Condos (ECs).

In this blog post, we’ll show you how resale buyers are earning $300-400k gains in just three years by investing in ECs. We share the untold story of ECs and their impressive returns from 2019 to 2022. Let’s go!

The Singapore property market has seen significant shifts in the past three years due to an undersupply of new properties completing in the same period. One of the noticeable trends that have emerged is that many resale property owners are making bigger profits than property buyers who have purchased directly from developers.

So it does seem that 80% of property agents on social media have got their forecasts from 2018-2022 wrong, believing that buying into resale properties will only lead to financial ruin due to lease decay and a short shelf life for leasehold properties.

Today, we will focus on one property segment where we see many resale buyers walking away with over $300-400k gains in just 3 years.

The Executive Condo segment was recently billed as a property comparable to a luxury “Lexus” sold at (Toyota) “Corolla” prices by ministers in Singapore.

Let’s take a look at one example in Buangkok. The executive condo Esparina Residence saw multiple resale owners making over 9% annualized gains. The top performing unit made 11.6%, after buying into a resale 3-bedroom of 1076 sqft. Bought in Aug 2019 for $989k and sold it off in Dec 2022 for $1.43mil.

This translates to a $440,000 profit in 3 years. Some would argue that they made high gains due to the upcoming Sengkang Grand Mall & Residences, which was launched recently.

When buying into a resale EC, potential buyers will also compare against a resale fully private condo in the same vicinity. The resale EC will tend to price lower, thanks to the first owner’s subsidised entry price.

This is where the opportunity for the resale EC buyers comes in. They too can take advantage of the lowered entry price compared to the neighbouring condos. Caveat here – this only works if you manage to negotiate for a fair market value.

Of course, the difficulty is identifying which resale ECs are truly undervalued.

Let’s continue with our research.

Next, let’s examine Belysa EC, a project with no new developments ongoing or upcoming nearby (unlike Esparina Residence).

Here, we see two owners walking away with over 9% annualized gains, or a quick $300k profit in just three years. These two parties did not purchase their property during the project launch. Instead, they entered the resale market once Belysa hit the 5-year minimum occupation period (MOP).

One of the sellers here purchased a 3-bedroom 1055sqft unit in Jun 2019 for $890k and sold it off in Sep 2022 for $1.2mil.

Finally, we have saved the best performing project for the last in this series.

Owner #1 10.2% Yearly Gains – $337k Profits

Owner #2 13% Yearly Gains – $460k Profits

Owner #3 14.5% Yearly Gains – $380

They made all this within 3 years, for a resale property purchase.

These are the kind of profits that new launch owners would happily exit with.

Blossom Residence

Once again, the top performing unit here was purchased in July 2020 for $1.12mil and they sold it off 2 years later! For $1.5mil! Did not even bother waiting for the 3-years sellers stamp duty to lapse!

So how can we learn from these set of property profiteers?

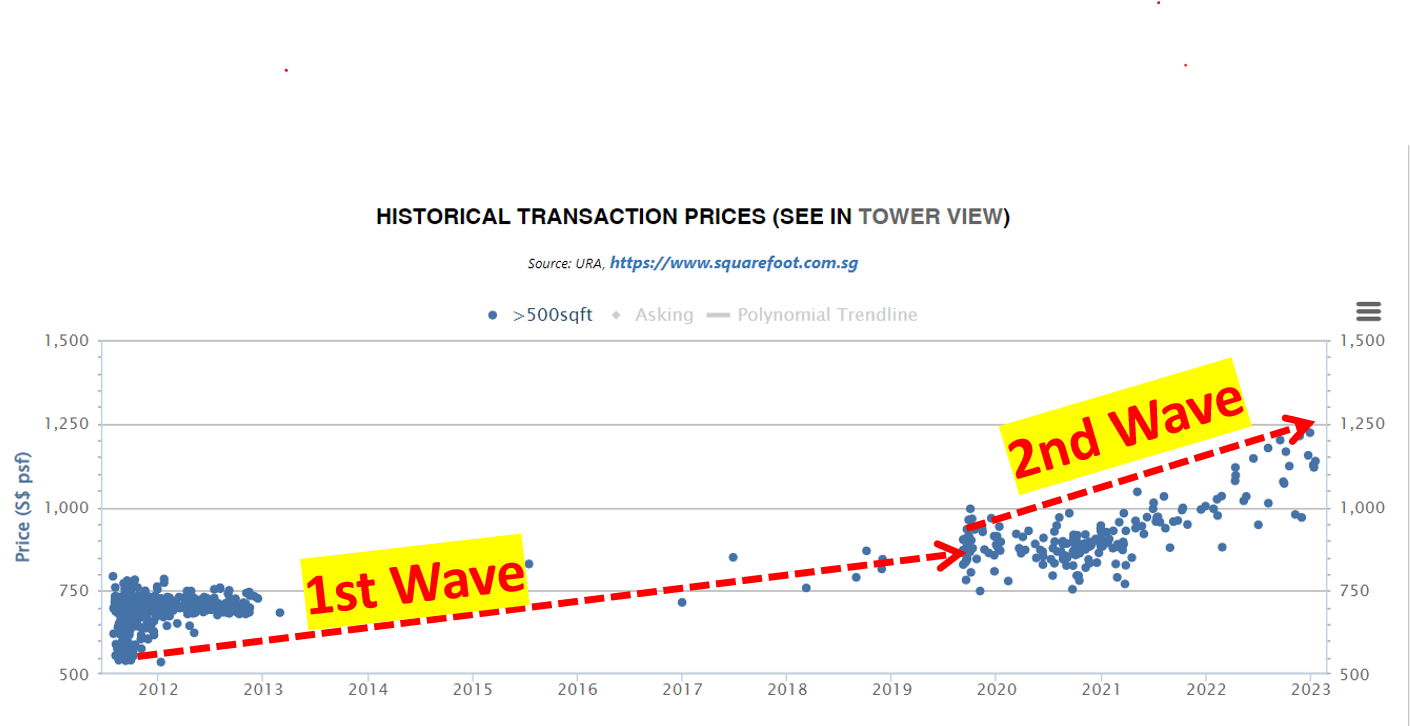

What we can conclude is, there seems to be two waves of property price increment for Executive Cnndos.

The first wave – first owners who purchased from the developers

The second wave – owners who purchase within the first year of the project hitting MOP.

Due to the lack of new condos in the market, when these second wave owners decide to sell their property when it is aged 8-9 years old, it presents a good option for the 3rd buyers to enter the private property market.

The property will still be of a young age and perceived to have a decent runway for the 3rd owners to profit from as well.

(Belysa, Esparina Res, Blossoms Res)

If you are also in the market and looking for similar plays, buying into a resale property with a priority to profit again, then this strategy will likely be profitable for another 3-4 year cycle.

Until the SLA, MND and/or URA are able to flood the market with an oversupply of new condos in the coming years, we are going to see ‘cheap Toyotas’ see it’s value appreciate to beyond a ‘Lexus’ price, all over again in 2023-2026.

How can you take advantage?

We have identified 3 new projects that have the characteristics to surpass the gains we have just discussed earlier.

In one of the projects we have identified, it is less than 500m to an existing MRT station, and you can purchase a ready-to-move-in project for less than $1.3mil. This makes it a very attractive entry proposition, where you would typically struggle to find a young 3-bed property under $1.3mil.

You would also find this project located in a very enviable location, at the doorstep of a huge BTO cluster that will see upgraders reaching the MOP mark over the next 5-6 years.

So to conclude, resale properties, especially ECs, are providing investors with more significant returns than new properties purchased directly from developers.

As the market continues to see shifts, it is crucial for potential property buyers to explore all the available options before investing.

If you are interested to know more about this opportunity, reach out to any of our Herohomes agents for a detailed discussion.

Yes, can discuss before you take action.

See you on the other side!