Your Safer Retirement Income: CPF Or Property?

Everyday the cost of living in Singapore increases, yet we are living longer and longer. What can you do to secure your financial future? What is your financial endgame? For Singaporeans, there are two sources of retirement wealth: CPF and Property. The question then becomes: which is a safer source?

HDB vs EC vs Private : 2020 to 2050

Let us begin with a simple scenario: assume you are now 30 years old, and have the ability to purchase an HDB, EC or Condo. By the time you are 60 years old, your purchase would be fully paid (assuming you take a 25 or 30-year loan). What would your situation be 30 years from now?

While forecasting is not an exact science, we can take a look at historical records and price movements, using widely available data, and extrapolate them to give an idea of what these properties would cost by the time you retire.

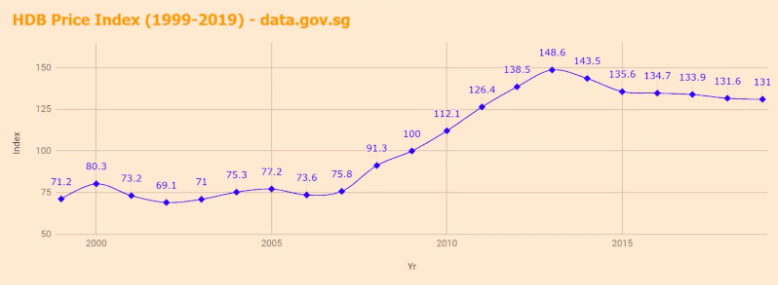

HDB Price Index

20 years ago, the average 4A HDB flat in the Tampines was about $293,000, but today the same flat goes for about $405,000. Thus, despite minor episodes of price dips in some years, price movement of property over the last 2 decades has generally been on an upward trend. In other words, property prices always go up in the long term.

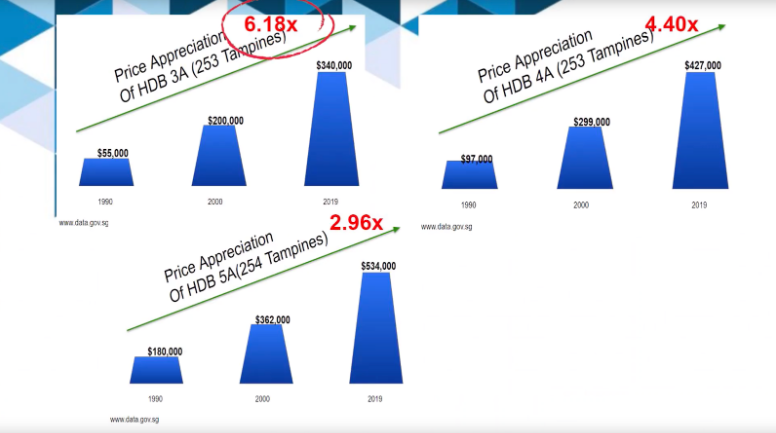

Now let us put that into perspective. Consider 3 scenarios where one had bought an HDB flat 30 years ago, in 1990, and had held on to it until today. How much would his HDB have appreciated by now?

Scenario A: HDB 3A 1990 – 2019: $55,000 to $340,000 (6.18x)

If someone had bought a 3A HDB flat at 253 Tampines in 1990 for $55,000, it would have jumped to $340,000 today – a whopping 6x increase!

Scenario B: HDB 4A 1990 – 2019: $97,000 to $427,000 (4.4x)Similarly the prices around his area have also increased. If he had bought a 4A HDB flat, it would have increased in price by 4.4x;

Scenario C: HDB 5A 1990 – 2019: $180,000 to $534,000 (2.96x)If he had bought a 5A HDB flat, it would have increased almost 3x.

In summary:

The Need to Cash Out

So all things considered, a 6x increase in valuation is quite an achievement in itself. However, price increase is only one side of the story. If he wants to retire, he has to find a way to tap onto the money in his 3-room HDB flat. The only way for him to release this equity, is to downgrade to a 2-room HDB flat. Buying a 2-room HDB flat is not something everyone is willing or able to do (due to size constraints).

Unsurprisingly, the scenario is progressively better if he had purchased his neighbour’s 5-room flat, which would have allowed him to downgrade to a 3-room flat, and have savings of about $170,000.

Private Property: EC & Condos

Let’s look at private property gains since the Pre-2000s.

If you had bought a 1,300ft2 Executive Condo in Simei Green, in 1997, it would cost you $578,000. Today, its valuation would have increased to $1,066,000.

Similarly, a 1,200ft2 private condo at Bayshore Park (Bedok South) was $612,000 in 1999. It has doubled to $1,224,000 today! There are countless cases of private property prices doubling in this time period.

In summary:

- Executive Condo Simei Green of 1,300ft2, 1997 – 2019: $578,000 to $1,066,000 (1.84x)

- Private Condo Bayshore Park of 1,200ft2, 1999 – 2019: $612,000 to $1,224,000 (2x)

So how does this all link to your retirement?

CPF Retirement Sum as a retirement gauge

As you already know, the CPF Retirement Sum has been increasing over the years. Why?

This is due to a number of factors.

One of the main reasons is simply inflation – the general price increase of goods & services. Consequently, the Retirement Sum has been increased by the government to keep up with this trend in the cost of living.

Since its introduction in 2003, it has increased from $80,000 to $181,000 – an average of 5% per year over the past 17 years. If this trend continues, that means someone in his 30s today will need to have a minimum sum of $563,000 in his CPF Retirement account!

Due to rising cost of living, Singaporeans of my generation might need to have over half a million dollars saved up eventually.

This projected Retirement Sum amount is required to fund your retirement years from 60 to 84 years. Those are years where you are potentially income-less.

Like it or not, Singaporeans have one of the longest life spans on earth. Currently, that span is 84.8 years.

You need to ask yourself: once you are 60 years old, how much would you need monthly for your daily living expenses?

Assuming you need $2,500 per month for a comfortable retirement, that means you need $30,000 per year, or $720,000 over 24 years!

That is a huge amount for just one person – you have to double this if you are a couple!

So even the estimated $563,000 in your CPF Retirement Account might not be sufficient.

But what if you had a fully paid property by the time you are 60, would it be an adequate source of income to last until you reach 84 years old?

Cash Out: Unlocking the Equity within

This is because, at the age of 60 years old is likely when you should cash out and downgrade your property to release the equity locked within your property.

Assuming you are willing to downgrade to a 3-room flat worth $350,000, then downgrading from a bigger HDB flat can potentially unlock $150,000-$180,000 for your retirement.

This may sound like a lot, but remember from our calculations above, you are likely going to need $30,000 per year to live comfortably. This means that you will only have enough for 6 years!

The situation is a lot better if you can downgrade from an Executive Condo or Private Condo. In fact, utilising this strategy at today’s prices could potentially unlock $650,000 or $1,650,000, respectively.

This would mean that you would have 22 to 55 years of comfortable retirement income.

The only caveat, of course, is that you have to ensure that your property is fully paid by 60 years old, so that you can cash out fully.

Remember that at the end of the day, it is not about what kind of property we first start of with. much the value of your properties can increase, but rather, how much you end up with when you reach 60 years old.

Endgame

In summary, it is important to note that with retirement planning, it is not how you start, but how you end. It does not matter what you own now, but rather how you go about cashing out in the most optimal way when the time comes.

Only then will you be able to give yourself the best chance to supplement your CPF savings by having a second source of retirement income. This is your endgame.

The contents of this article were taken from one of our regular video series. Please subscribe to Hero Homes to learn more.

Reference

- HDB Resale Price Index (https://www.hdb.gov.sg/cs/infoweb/doc/resale-price-index-chart & www.data.gov.sg)

- Retirement sum increment because of inflation Straits Times. (15 November, 2019). (https://www.straitstimes.com/singapore/manpower/cpf-basic-retirement-sum-should-be-regularly-adjusted-so-payouts-keep-pace-with)

- Singaporeans have world’s longest life expectancy at 84.8 years. Straits Times. (20 June, 2019). https://www.straitstimes.com/singapore/health/singapore-tops-in-life-expectancy-at-848-years

- Retirement Sum Scheme CPF (https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-scheme)

- Forward Flat Rate Inflation Calculator (www.calculator.net)

- Simei Green & Bayshore price chart prices (www.squarefoot.com.sg)