🔮 The Same Trap That HDB Owners Fell Into in 2017… Is Starting Again

You probably don’t remember 2017 to 2019. Most people don’t. But that period quietly reshaped Singapore’s property market — and

You probably don’t remember 2017 to 2019. Most people don’t. But that period quietly reshaped Singapore’s property market — and

Why This Isn’t Your Typical Executive Condo Success Story Anymore ⚡ Quick Reference : Coastal Cabana at a Glance

Why HDB Sellers Can’t Afford to Wait Until 2026 When the news broke that the 15-month wait-out rule may soon

Editor’s Note: This post began as a client case study video on our Instagram and TikTok. We had so many

Aurelle EC: Why This “Golden” Executive Condo May Outshine Its Neighbours This article began as a video we posted on

Every week, I get the same request from young families and first-time condo buyers: “3-bedder, under $1.5M, near MRT, full

“This Feels Smaller Than Our HDB” They could afford $2.8M. But none of the $2.8M homes felt like home. For

Why Singapore’s Most Expensive Region Might Be Its Most Undervalued (For Now) Chapter 1: When the Floor Becomes the Ceiling

Why Many Get Stuck At Their First Home — And How Some Quietly Build Capital Instead Recently, I had a

The Boutique Condo Paradox: Why Some Projects Fly, While Others Flatline By Heikal Shafrudin – HeroHomes.sg ✩️ Most people assume

Why I Told My Friends Not to Buy 1-Bedder Condos in 2025 — Even Though They Could Afford It Back

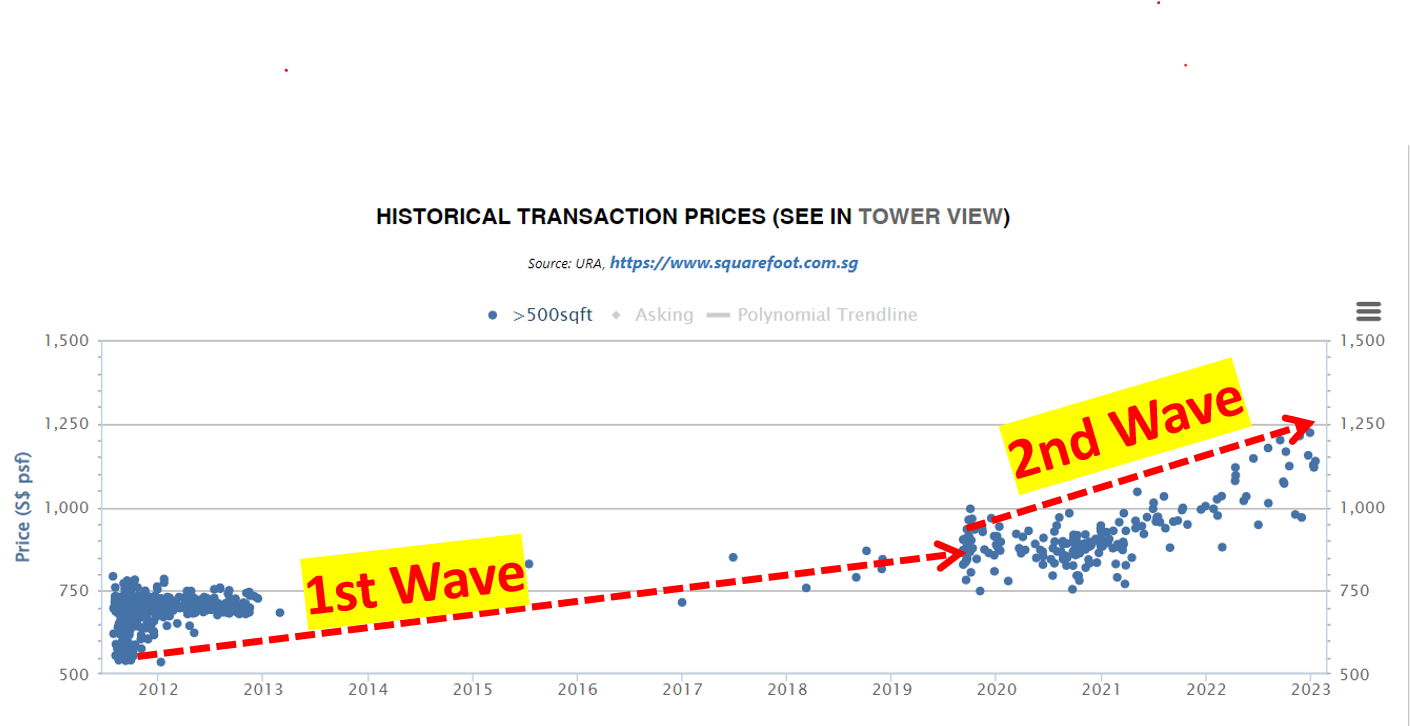

Are Resale Condo Prices Peaking? What I Discovered After Studying 10 Years of Data By Heikal Shafrudin, HeroHomes.sg Over the

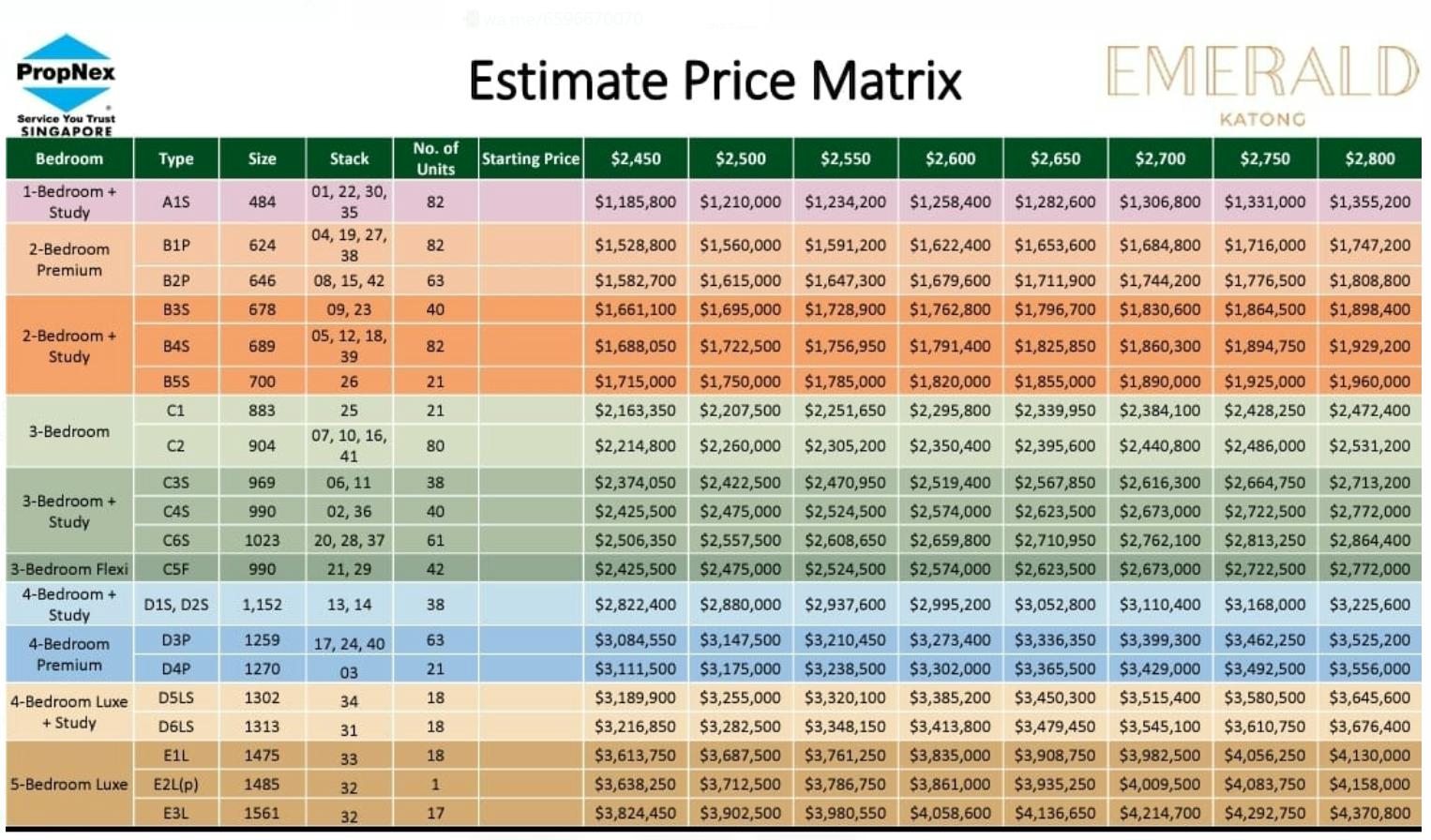

Introduction Emerald of Katong, developed by Sim Lian Group, is set to become a standout residential development in District 15’s

Secure Your Future: Unlocking Retirement Income Through Smart Property Investments Understanding the Urban Redevelopment Authority (URA)’s recent regulations is crucial,

Introduction Welcome to your next big step in real estate! Transitioning from an HDB to a new launch condo offers

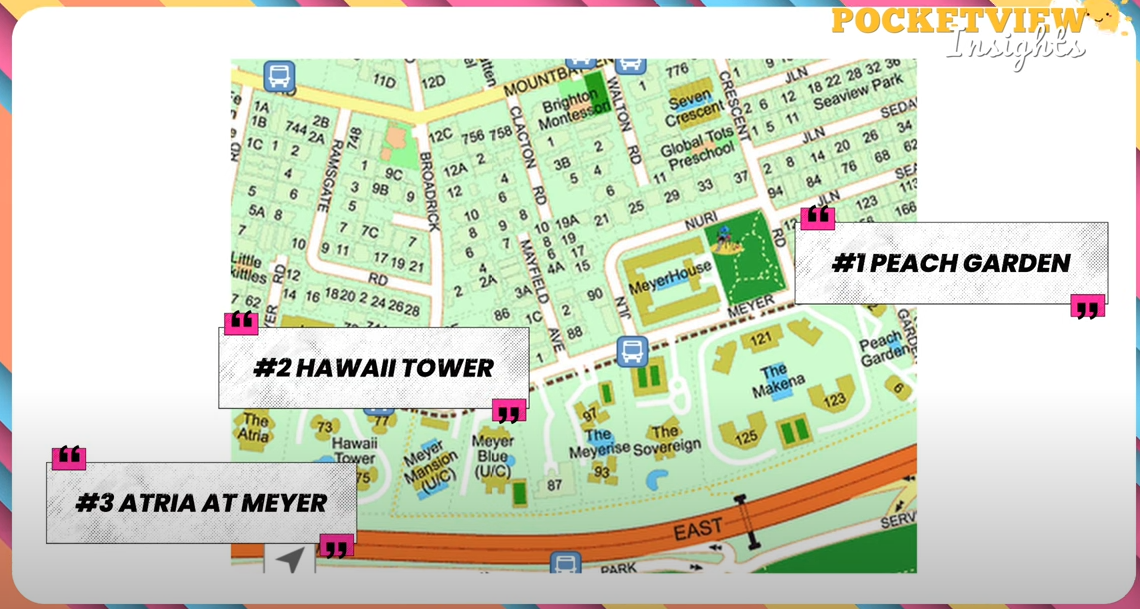

When considering a new property investment, especially in prestigious areas like Meyer Road, making an informed decision is crucial. Meyer

Investing in property isn’t merely about selecting the right location or finding the perfect unit; it’s also about identifying opportunities

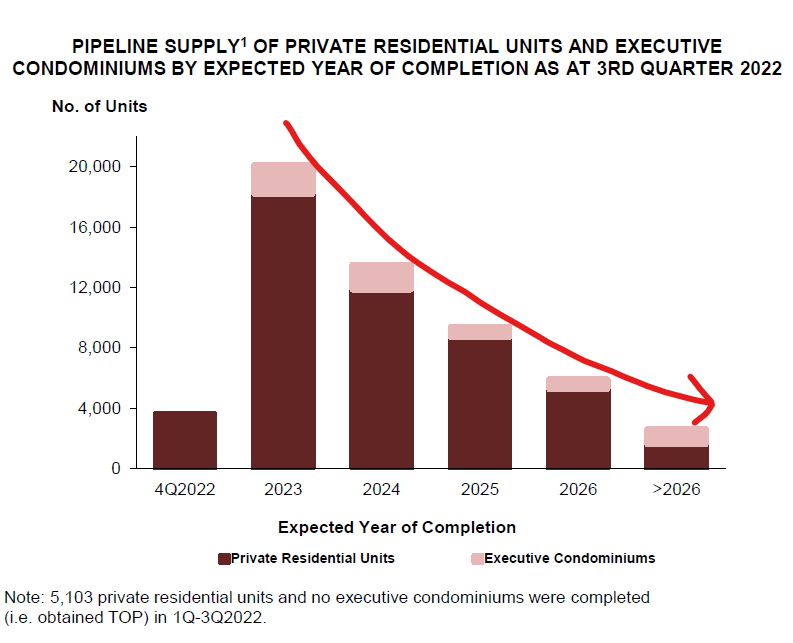

Singapore’s rental market is ready to turn over a new leaf. The 3rd and 4th quarters of 2023 saw a

No doubt, J’den was one of the most successful property launches in Singapore by the end of 2023. Just in

Why did my client upgrade from a 4-room flat to a 2-storey Executive Maisonette (EM) in Pasir Ris, and how

Retirement is one of the biggest worries for most Singaporeans. In 2023, ROSA’s research revealed that only 34% think their

Did you know your Central Provident Fund (CPF) accrued interest can negatively affect you? Without proper knowledge of the CPF

Before delving into the nitty-gritty of today’s topic, let’s first answer the question you’re probably itching to ask: When is

What Nightmares Do Buyers Face When Getting Resale Flats? Successfully purchasing a resale property can often feel like accomplishing

Planning to upgrade from your current Built-To-Order (BTO) flat? Before getting to all the nifty and exciting parts of your

If you’re on the hunt for a resale property with a budget of $1.8M, let me take you up to

When it comes to being the safest Core Central Region (CCR) resale property in the heart of Singapore, nothing packs

For savvy property owners and industry professionals, understanding the ever-evolving dynamics of the Housing & Development Board (HDB) resale market

Singapore’s dynamic real estate market recently saw the introduction of new property cooling measures. The highlight of these measures is

Ready to dispel the myth that buying a resale property is a surefire way to lose money in the Singapore

Choose The Right Unit in The Right Project You see advertisements from property agent highlighting the benefits of new launch

The resale prices of HDB (Housing and Development Board) flats in Singapore are influenced by multiple factors, including the supply

Just last Saturday I brought a buyer down to a HDB executive apartment at Pasir Ris it was the last

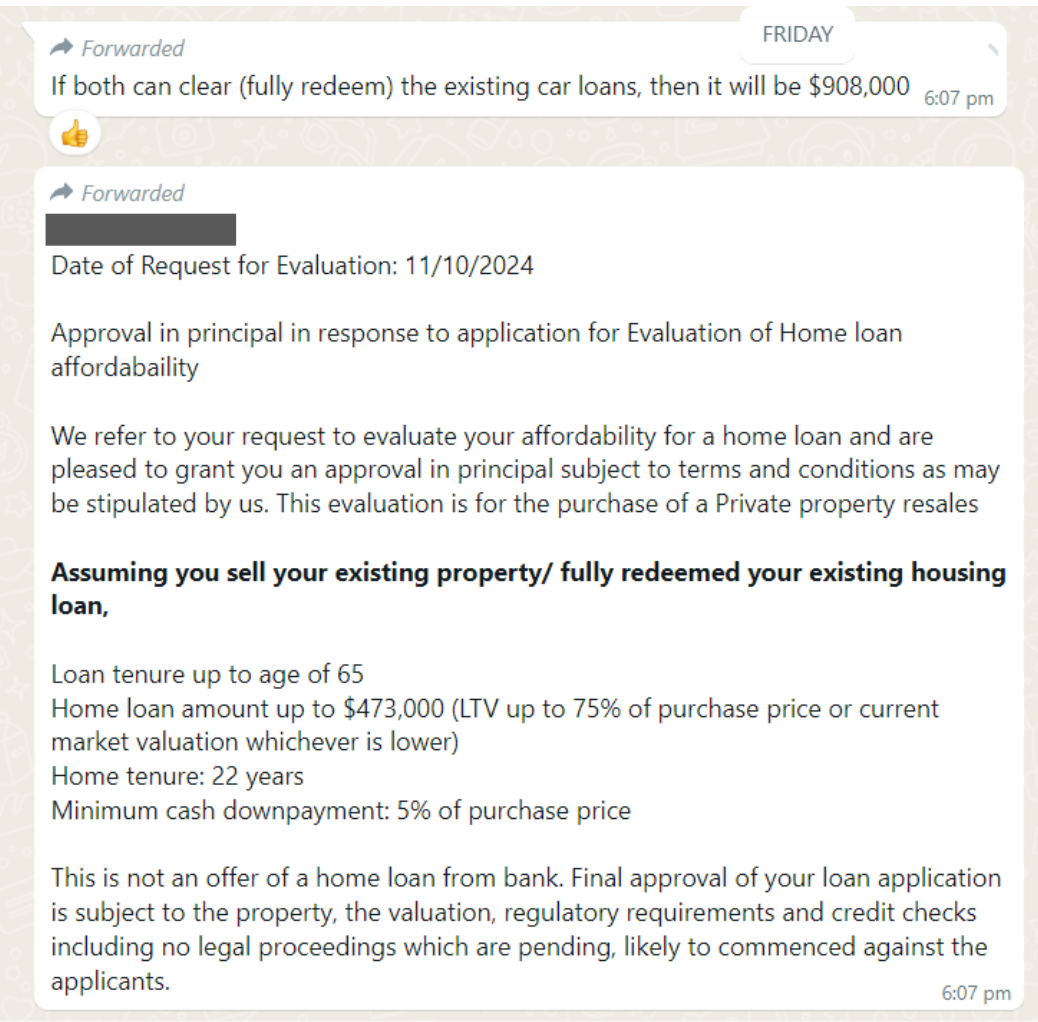

If you’re looking to upgrade to a Private Property and move in immediately, you might consider purchasing a resale property

Have you wondered why some properties sell for record prices while some are sold at market or below market prices?

What is HDB? HDB is a sub-government branch established in 1960 to resolve Singapore’s housing crisis. Continue reading.

Would you invest in a property located in a prime location or a property 23 km north away from Central

This article is for subscribers only due to the contents of the post. If you not already a subscriber please

Before March 2014, when you were selling your HDB flat you would have to first apply for a HDB valuation.

Why are some properties “unavailable” on Propertyguru? You are now on the hunt for your dream home but when you

How can you increase your chances of getting alot more cash for your HDB flat when selling? You can use

Private Condo Ownership Among Malays Over the past 3 years, my partner Elfi and I have been helping the Malay

Should you sell your HDB flat immediately after the 5th year or should you wait? If you’re not already aware,

We’ve been directing our marketing efforts to today’s generation of HDB upgraders over the past 3 years. Majority of

How Property Owners Make 6 Digit Profits In this article, I will share with you an important concept when investing

One of my past clients grew up in that estate and they referred me to their parents. The elderly couple

admin@herohomes.sg

+65 92709040

Please enter your username or email address. You will receive a link to create a new password via email.